Why My Portfolio Didn’t Break When Illness Hit — A Real Talk on Smarter Asset Spread

What happens to your money when health suddenly crashes? I learned the hard way. When a surprise diagnosis drained both energy and savings, I realized my finances weren’t built for shock. But one thing saved me: spreading assets the right way. It wasn’t about big gains — it was about staying afloat. This is how I restructured my financial defense, not with complex schemes, but with calm, clear choices that actually work when life gets messy. The experience taught me that financial strength isn’t measured by peak returns, but by how well you can endure unexpected storms without losing stability. That kind of resilience doesn’t come from luck — it comes from intentional planning, diversified access, and understanding the real purpose of money in times of crisis.

The Wake-Up Call: When Health Shocks Expose Financial Gaps

It started with fatigue — the kind that coffee couldn’t fix. Then came the tests, the referrals, and finally, a diagnosis that changed everything. In the weeks that followed, my world narrowed to hospital rooms, medication schedules, and insurance forms. What I didn’t expect was how quickly my financial footing would erode. I had savings, a steady job, and no major debt — on paper, I was financially responsible. But within three months, those savings were gone. Specialist visits weren’t fully covered. Travel for treatment added up. My ability to work fluctuated, and income became unpredictable. I wasn’t alone; studies show that nearly 60% of personal bankruptcies in some countries are tied to medical expenses, even among insured individuals. The shock wasn’t just physical — it was financial whiplash. I had planned for retirement, for vacations, for my children’s education — but not for a scenario where both income and health vanished at once.

That’s when I realized the flaw in my thinking: I had equated financial safety with a growing bank balance and a retirement account. But safety isn’t just about accumulation — it’s about accessibility and structure. My emergency fund was modest and housed in a single account. My investments were mostly long-term, locked into vehicles that penalized early withdrawal. When the crisis hit, I had no immediate access to diversified sources of value. I had to borrow from family, delay payments, and sell investments at a loss — choices that deepened the stress. The experience exposed a gap many overlook: stability in good times doesn’t guarantee resilience in crisis. True financial preparedness means designing a system that holds up not when everything is going well, but when multiple pressures hit simultaneously. Health events don’t care about your five-year plan — they demand solutions now. And if your money isn’t structured to respond, even a strong financial past can lead to a fragile present.

Asset Diversification Isn’t Just for Markets — It’s for Life Protection

Most people think of diversification as a way to boost investment returns or reduce market volatility. They spread stocks across sectors or add bonds to lower risk. But this narrow view misses a deeper purpose: protection against life’s disruptions. True diversification isn’t just about what you own — it’s about how, when, and where you can access it. During my recovery, I began to see my assets not as a portfolio to be optimized for growth, but as a layered defense system. Each component needed to serve a function — some for immediate use, others for sustained support, and some to remain untouched, preserving long-term security. This shift in mindset — from performance to resilience — changed everything.

Imagine relying on a single engine to power a ship through a storm. If that engine fails, the vessel drifts. That’s what happens when all your financial resources are tied to one income stream or one type of account. Diversification, in this context, means building redundancy. It means having funds available even if one institution is inaccessible, one account is frozen, or one income source disappears. It includes not only different asset classes — cash, bonds, real estate, equities — but also different access mechanisms, custody locations, and liquidity profiles. For instance, keeping all your savings in a high-yield account is smart — unless that bank’s online system goes down during a hospital stay, or the account requires in-person verification you can’t provide. Real protection comes from spreading not just risk, but access.

This broader definition of diversification also considers timing. Some assets are meant to grow over decades, and withdrawing them early can trigger penalties or tax consequences. Others are designed for flexibility — accessible without fees, without forms, without delays. A resilient financial structure ensures that not all your value is subject to the same rules or restrictions. When illness struck, I learned that a well-diversified portfolio isn’t one that merely survives a market downturn — it’s one that supports you when your body or mind can’t. That kind of security doesn’t come from chasing returns. It comes from asking a different question: not “How much can I earn?” but “How can I ensure I’ll have what I need, when I need it, no matter what?”

The Three Circles of Financial Shock Resistance

To rebuild my financial confidence, I developed a simple model: the Three Circles of Shock Resistance. This framework helped me organize my assets not by expected return, but by function and accessibility. The first circle is immediate-access funds — money you can use within hours or days. This includes cash, checking accounts, and highly liquid savings vehicles like money market funds or short-term CDs with penalty-free withdrawal options. These funds cover urgent expenses: medical co-pays, transportation, prescription costs, or household bills when income slows. During my illness, this circle was the first to deplete, but because it was separate from long-term investments, I didn’t have to sell stocks at a market low to pay for a doctor’s visit.

The second circle consists of mid-term flexible assets — resources that can be accessed within weeks or months without significant loss. This includes certain insurance-linked instruments, such as hybrid life insurance policies with living benefits, or investment accounts with systematic withdrawal plans. It might also include non-retirement brokerage accounts with diversified holdings, where you can sell specific assets without triggering broad penalties. These assets bridge the gap between emergency cash and long-term wealth. They provide breathing room — enough to cover several months of reduced income without derailing your future. I used this circle to manage recurring costs while I regained strength, drawing small amounts regularly rather than liquidating everything at once.

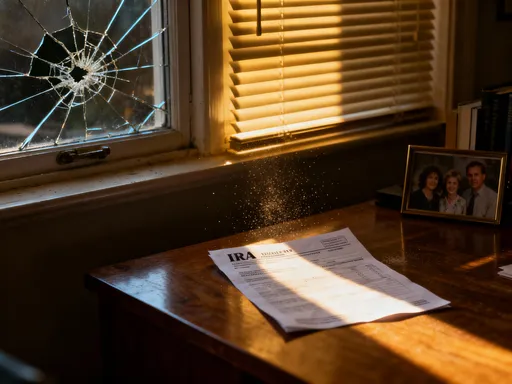

The third circle is long-term protected holdings — assets meant to remain untouched unless absolutely necessary. This includes retirement accounts like 401(k)s or IRAs, real estate with equity, or long-duration investments in diversified funds. These are the foundation of future security, and the goal is to avoid early withdrawals that could trigger taxes or penalties. However, even this circle can be designed with resilience in mind. For example, Roth IRAs allow penalty-free withdrawal of contributions (though not earnings) at any time, offering a controlled release valve in extreme cases. The key is balance: each circle serves a role, and over-reliance on any one weakens the whole system. By mapping my assets into these three layers, I gained clarity. I could see where I was over-concentrated and where I had gaps. More importantly, I stopped viewing money as a single pool to be drawn from — and started seeing it as a dynamic structure, designed to adapt.

Liquidity vs. Lock-In: Choosing Access Without Penalty

One of the most painful lessons from my crisis was discovering how much of my money was technically mine — but practically out of reach. I had money in fixed deposits with early withdrawal penalties that erased all earned interest. I had retirement savings that would incur taxes and a 10% penalty if accessed before age 59½. In a moment of urgency, these weren’t assets — they were locked boxes. Liquidity, the ability to convert assets into usable cash quickly and without cost, turned out to be just as important as the amount saved. Yet many traditional financial plans prioritize growth and tax deferral over access, assuming that time and health will always be on your side. That assumption is fragile.

The trap of illiquidity isn’t always obvious. A five-year CD might offer a higher interest rate, but if you need the money in year two, you could lose months of gains — or even principal. Similarly, employer-sponsored retirement plans often restrict access to loans or hardship withdrawals, requiring documentation that’s hard to produce during a medical crisis. I learned that liquidity isn’t just about having cash — it’s about having options. One strategy I adopted was laddering short-term instruments: instead of putting all my emergency funds into a single long-term CD, I spread them across multiple accounts with staggered maturity dates. This way, a portion becomes available every few months without penalty, providing a steady stream of accessible funds.

Another approach is pairing low-risk assets with quick-disbursement features. For example, some insurance products offer cash value accumulation with the option to take policy loans, which can be accessed faster than traditional bank loans and without credit checks. While these tools aren’t for everyone and require careful review, they can serve as a bridge in emergencies. The goal isn’t to abandon long-term growth — it’s to ensure that not all your financial value is subject to the same access rules. I now aim to keep at least six to nine months of essential expenses in the first two circles of my shock resistance model, with clear rules for when and how to use each. This balance allows me to pursue growth in the long term while maintaining a safety net that won’t vanish when I need it most.

Geographic and Institutional Spreading: Don’t Keep All Eggs in One Backyard

For years, I kept all my financial accounts at the same bank — for convenience, for familiarity, for the small perk of bundled services. But when I was hospitalized for weeks, I realized how vulnerable that made me. My primary account required two-factor authentication through a mobile app I couldn’t reliably access from a hospital bed. My spouse, though trusted, wasn’t an authorized signer on all accounts and faced delays getting access. Meanwhile, a regional power outage temporarily took down the bank’s online system. In that moment, my money was technically safe — but functionally inaccessible. That experience taught me a critical lesson: diversification must extend beyond asset types to include institutions and locations.

Spreading accounts across multiple financial institutions — different banks, credit unions, or brokerage firms — reduces the risk of total disruption. If one institution experiences a technical issue, regulatory freeze, or local crisis, others remain operational. Some people take this further by holding accounts in different countries, where legal and financial systems are separate — though this requires understanding tax implications, currency risks, and access logistics. Even within one country, using a combination of national banks, local credit unions, and online-only institutions can enhance resilience. Online banks often offer higher interest rates and robust digital access, while local institutions may provide in-person support when needed.

Equally important is planning for authorized access. During a health crisis, you may not be able to manage your accounts. Ensuring that a trusted family member has power of attorney or is listed as a joint owner — with clear boundaries — can prevent delays in paying bills or accessing funds. I now maintain a secure, up-to-date list of all accounts, login methods, and contact information, shared only with my spouse and kept in a fireproof home safe and a digital vault. I also use institutions that offer reliable customer service, including phone support with quick verification processes. These steps don’t eliminate risk, but they reduce the chance that a financial system failure will compound a personal crisis. Money that can’t be accessed when needed is no protection at all.

The Role of Insurance and Non-Financial Buffers

While assets are essential, they’re only part of the resilience equation. Insurance products and non-financial support systems act as powerful force multipliers, reducing the amount of money you need to draw from savings during a crisis. Health insurance, for instance, is the first line of defense — but not all plans offer the same protection. High-deductible plans may lower premiums, but they shift more costs to the patient during treatment. I now prioritize coverage that balances affordability with meaningful out-of-pocket maximums, ensuring that a serious illness won’t lead to unlimited expenses. Equally important are disability insurance and critical illness riders, which provide income replacement or lump-sum payments upon diagnosis — funds that can cover living expenses when work isn’t possible.

Life insurance with cash value, while often debated, served a dual purpose in my recovery. The death benefit protected my family, but the accumulated cash value offered a source of funds I could borrow against without triggering taxable events. These policies aren’t investments in the traditional sense, but they provide a layer of financial flexibility that pure market accounts don’t. I also learned to value non-financial buffers: community support, flexible work arrangements, and even telehealth services that reduced travel costs. A neighbor who picked up prescriptions, a manager who allowed remote work during recovery, or a support group that shared resources — these didn’t appear on my balance sheet, but they reduced financial strain.

The synergy between insured protection and liquid assets is crucial. Insurance reduces the size of the financial hole; accessible savings provide the tools to climb out. Together, they create a more robust safety net than either could alone. I now review my insurance coverage annually, not just for cost, but for how well it aligns with potential health risks. I also keep a file of all policies, beneficiaries, and claims procedures — because in a crisis, knowing what you’re entitled to is as important as having the entitlement itself. Preparedness isn’t just about money; it’s about systems that work when you’re too weak to manage them yourself.

Building Your Own Crisis-Ready Financial Structure

Resilience isn’t built in a day — it’s grown through small, consistent choices. After my recovery, I didn’t overhaul my finances overnight. Instead, I started with a simple audit: I listed every asset, every account, every insurance policy. Then I mapped them into the three circles — immediate, mid-term, long-term — asking three questions for each: Can I access this quickly? Will I lose value if I do? What would happen if I couldn’t manage it myself? The gaps were clear. I had too much in long-term, locked accounts. I relied on one institution. I lacked clear access plans for my family.

My next step was gradual adjustment. I didn’t liquidate retirement accounts — but I redirected new savings into more flexible vehicles. I opened a second bank account at a different institution, funding it with three months of essential expenses. I reviewed my insurance and added a disability rider. I updated legal documents to include durable power of attorney. Each change was small, but together, they built a new foundation. I also set a rule: no single institution holds more than 40% of my liquid assets. This self-imposed limit ensures that no single point of failure can disable my financial response.

For anyone beginning this process, the goal isn’t perfection — it’s progress. Start by listing your accounts and their access terms. Identify where you’re over-concentrated. Consider what would happen if you couldn’t log in, sign a form, or visit a branch for weeks. Talk to your family about your wishes. Update beneficiaries. Explore options for penalty-free access without sacrificing long-term goals. Remember, financial preparedness isn’t a sign of fear — it’s an act of care. It says you value your family’s stability, your own peace of mind, and your ability to face the unexpected with dignity. My illness didn’t just change my health — it reshaped my understanding of money. I no longer measure wealth by the number in my accounts, but by the confidence that those numbers will still serve me when life doesn’t go as planned. That’s not pessimism. That’s empowerment. And it’s available to anyone willing to build not just for success — but for survival.