How I Turned My Finances Around: A Real Income Boost Journey

What if improving your income wasn’t about working more, but managing smarter? I was stuck in the same paycheck-to-paycheck cycle—until I changed my approach. This isn’t a get-rich-quick story, but a real journey of small, strategic shifts that added up. From spotting hidden financial leaks to building sustainable income streams, I’ll walk you through what actually worked, what didn’t, and how you can apply these lessons without taking reckless risks. It’s about making thoughtful decisions, staying consistent, and designing a financial life that supports the kind of freedom and stability so many of us deeply desire. This is not a fantasy—it’s a practical roadmap grounded in real experience.

The Wake-Up Call: When My Money Started Working Against Me

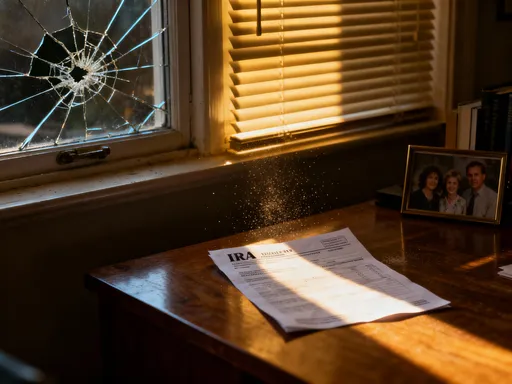

For years, I believed that as long as I had a steady job and paid my bills on time, I was doing fine. I never thought much about where my money went beyond the basics—rent, groceries, utilities, and the occasional treat. But over time, something felt off. Despite working full-time and receiving annual raises, I wasn’t getting ahead. In fact, I was falling behind. One winter, my car broke down unexpectedly, and I realized I didn’t have enough saved to cover the repair without using a credit card. That moment was a wake-up call. It wasn’t just about the car—it was about the growing gap between my income and my ability to handle life’s surprises.

That’s when I started tracking every dollar I spent. At first, it felt tedious, even overwhelming. But within a few weeks, patterns emerged. I was paying for three subscription services I hadn’t used in months—one for a fitness app I never opened, another for a meal kit I canceled but forgot to confirm, and a third for cloud storage I didn’t need. I also realized how often I was making impulse purchases during lunch breaks or while browsing online late at night. These weren’t huge amounts individually, but together, they totaled over $200 a month—money that could have gone toward savings, debt reduction, or meaningful experiences. More alarming was the complete lack of an emergency fund. I had no buffer, no safety net. My financial stability was entirely dependent on a single income stream with no margin for error.

This experience taught me a critical lesson: income alone does not guarantee financial health. It’s how you manage what you earn that truly matters. Many people in their 30s and 40s find themselves in similar situations—juggling family responsibilities, rising costs, and stagnant wages. The emotional toll can be heavy, leading to stress, sleepless nights, and a sense of helplessness. But the good news is that change is possible. The first step isn’t earning more—it’s seeing clearly. Awareness creates the foundation for action. Once I understood where my money was going and how vulnerable I was, I could begin to make intentional choices. That clarity didn’t solve everything overnight, but it gave me the motivation to keep going. Financial transformation starts not with a windfall, but with a decision to pay attention.

Rethinking Income: Beyond the 9-to-5 Paycheck

For a long time, I equated income with my job. My salary was the engine that powered everything—housing, groceries, childcare, and savings. But relying solely on one source of income is like building a house on a single pillar. If that pillar wobbles, the whole structure is at risk. I began to understand that real financial progress comes not from working more hours, but from diversifying how I earn. This doesn’t mean burning out with side hustles; it means being strategic about creating additional, sustainable streams of income that align with my skills and lifestyle.

I started by looking at what I already knew how to do. I had years of experience writing reports, creating presentations, and managing small projects at work. I realized these skills could be valuable outside my full-time role. I began offering freelance writing services on a flexible basis—helping small businesses craft website content, newsletters, and social media posts. At first, the income was modest, but it built over time. The key was consistency, not intensity. I didn’t work every night or weekend. Instead, I set clear boundaries—only taking on projects that fit my schedule and didn’t interfere with family time. This approach allowed me to earn extra income without sacrificing my well-being.

As I gained confidence, I explored other opportunities. I started offering short consulting sessions for professionals who wanted help organizing their workspaces or improving productivity. Later, I created a simple digital guide based on my organizational methods and began selling it online. These weren’t get-rich-quick schemes, but they provided passive income with minimal ongoing effort. The real benefit wasn’t just the extra money—it was the sense of control and resilience it gave me. If my main job faced uncertainty, I had other sources to fall back on. Diversification doesn’t eliminate risk, but it reduces dependence on any single income stream.

When considering side income, it’s important to assess the balance between time and return. Some opportunities require significant upfront effort for little payoff. Others may seem lucrative but demand more energy than they’re worth. I learned to ask myself three questions before starting anything new: Does this align with my skills? Can I do it without disrupting my family life? And will the return justify the time invested? This filter helped me avoid overcommitting or undervaluing my work. The goal isn’t to hustle endlessly—it’s to create smart, scalable streams that grow alongside your life. Income growth isn’t about doing more; it’s about doing what matters most, in a way that supports long-term stability.

The Power of Micro-Saving: Turning Pennies Into Progress

When I first tried to save money, I thought I needed to make big sacrifices—cutting out all dining out, canceling every subscription, and living on a strict budget. But that approach didn’t last. It felt too restrictive, and eventually, I gave up. What changed was my mindset: instead of focusing on deprivation, I started focusing on design. I discovered the power of micro-saving—automating small, consistent contributions that added up over time without disrupting my daily life. This subtle shift made all the difference.

I set up automatic transfers so that 10% of every freelance payment went directly into a separate savings account. I didn’t see the money in my main account, so I didn’t miss it. I also created a rule for windfalls—any unexpected money, like tax refunds or birthday gifts, was split immediately. Half went to savings, and half could be used freely. This way, I still got to enjoy the bonus, but I also made progress toward my goals. Over the course of a year, these small actions added up to over $1,500 in savings—money I hadn’t even noticed missing.

The beauty of micro-saving is that it reduces decision fatigue. Instead of having to choose every day whether to save or spend, the system does it for you. This makes it easier to stay consistent, even during busy or stressful times. It also creates psychological wins. Seeing your savings grow—even slowly—builds confidence and motivation. You begin to believe that progress is possible, and that belief fuels further action. I also applied this principle to reducing debt. By rounding up each bill payment and putting the difference into a debt-reduction fund, I was able to pay off a credit card balance six months earlier than planned.

Micro-saving isn’t about getting rich overnight. It’s about building momentum. Small actions, repeated over time, create lasting change. It’s like watering a plant every day—each drop seems insignificant, but over weeks and months, you see growth. For busy women managing households and careers, this approach is especially effective because it works within real life, not against it. You don’t need perfect discipline or a huge income to start. You just need a simple system and the willingness to begin. Over time, those pennies turn into progress—and progress turns into peace of mind.

Risk Control: Protecting Gains Without Playing It Too Safe

One of the hardest lessons I learned was that growth requires risk—but not recklessness. Early on, I invested a significant portion of my savings into what I thought was a ‘sure thing’—a friend’s small business venture that promised high returns. I was excited and eager to grow my money quickly. But the business failed, and I lost most of what I had invested. It was a painful experience, not just financially, but emotionally. I felt embarrassed and discouraged. But it also taught me a valuable lesson: risk is inevitable in any effort to grow income, but it must be managed wisely.

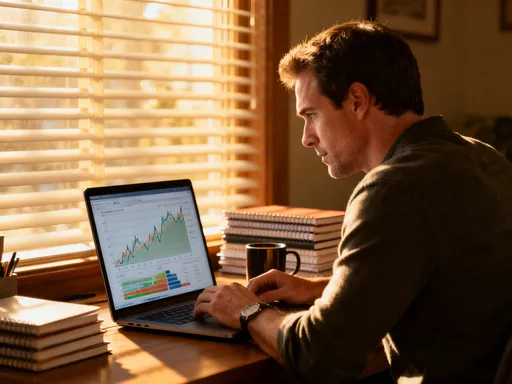

Now, I use a simple framework for evaluating any financial opportunity: assess, diversify, and cap exposure. First, I assess whether the opportunity aligns with my knowledge and values. If I don’t understand how it works, I don’t invest. Second, I diversify—spreading my resources across different areas so that no single loss can derail me. For example, I might allocate a small portion to a side project, another to a low-cost index fund, and keep the rest in accessible savings. Third, I cap my exposure—never risking more than I can afford to lose. This rule has kept me from making impulsive decisions based on emotion or hype.

Risk control also means avoiding emotional decisions. When markets rise, it’s tempting to jump in out of fear of missing out. When they fall, it’s easy to panic and sell at a loss. I’ve learned to step back and focus on my long-term goals instead of short-term fluctuations. I review my decisions calmly, using data rather than emotion. I also build in safeguards—like automatic contributions to retirement accounts and emergency funds—so that even if one area underperforms, my overall financial health remains stable.

Protecting your gains doesn’t mean avoiding all risk. That approach can be just as harmful, because inflation and rising costs erode purchasing power over time. The goal is balanced growth—taking calculated risks that offer reasonable returns while maintaining security. This requires patience and discipline, but it leads to more sustainable results. Confidence comes not from avoiding risk, but from knowing you have a plan to manage it. When you control risk wisely, you create the space to grow—without fear of losing everything.

Skill Stacking: The Hidden Engine of Income Growth

One of the most powerful tools I discovered wasn’t a new job or a lucky break—it was skill stacking. This concept refers to combining multiple existing skills to create a unique, high-value offering. I didn’t need to become an expert in everything; I just needed to connect what I already knew in a way that solved real problems for others. My background included professional writing, basic graphic design, and project management. On their own, each skill was useful but common. But when I combined them, I could offer a complete content package—writing, formatting, and delivering materials on schedule—that clients were willing to pay a premium for.

This approach allowed me to charge more than if I had offered just one service. A client didn’t need to hire three people—they could get everything from me. That convenience and efficiency increased my value. I didn’t waste time chasing certifications or learning skills I’d never use. Instead, I focused on filling small gaps—taking a short course on design tools or improving my time management—so I could deliver better results. The return on that investment was immediate and measurable.

Skill stacking works because the market rewards problem solvers. People and businesses don’t pay for isolated skills—they pay for solutions. If you can streamline a process, save time, or reduce stress, you become more valuable. For women balancing multiple roles, this is especially empowering. You likely already possess a wide range of skills—from organizing family schedules to managing budgets to communicating effectively. These are transferable and in demand. The key is recognizing them as assets and learning how to package them effectively.

To build your own skill stack, start by listing your current abilities. Then look for overlaps—areas where two or more skills can work together. For example, if you’re good at cooking and teaching, you might create simple meal-planning guides for busy families. If you’re organized and tech-savvy, you could help others set up digital systems for home management. The goal isn’t to do everything, but to find a niche where your combination of skills stands out. Over time, this approach leads to higher income, greater satisfaction, and more control over how you work. Skill stacking turns ordinary abilities into extraordinary opportunities.

The Mindset Shift: From Scarcity to Strategic Abundance

For years, I operated from a place of scarcity—believing there wasn’t enough: not enough time, not enough money, not enough opportunity. This mindset shaped my decisions in subtle but powerful ways. I hesitated to raise my rates, fearing clients would leave. I avoided investing in myself, thinking it was too expensive. I felt guilty when I earned more, as if success came at someone else’s expense. These beliefs limited my growth more than any external factor ever could.

The turning point came when I began to reframe my relationship with money. I shifted from scarcity to what I now call strategic abundance—a mindset focused on value creation, long-term growth, and responsible risk. I realized that money isn’t a fixed pie; it’s a flow that expands when you contribute meaningfully. Instead of asking, ‘Can I afford this?,’ I started asking, ‘How can I create value that justifies this investment?’ This change in thinking opened new possibilities. I became more confident in setting prices, pursuing opportunities, and planning for the future.

Mindset affects behavior. When you believe you deserve financial stability, you’re more likely to take steps toward it. When you trust your ability to adapt, you’re less afraid of change. This shift didn’t happen overnight. I had to challenge old beliefs, celebrate small wins, and surround myself with positive influences—books, podcasts, and communities that reinforced healthy money attitudes. I also practiced gratitude, which helped me appreciate what I had while still striving for more.

Confidence, not just competence, fuels financial success. You can have all the skills in the world, but if you doubt your worth, you’ll undercharge, underdeliver, and underperform. By cultivating a mindset of strategic abundance, I became more proactive, resilient, and empowered. I stopped waiting for permission and started making decisions that aligned with my goals. This internal shift was the foundation for every external change that followed. Your mindset shapes your reality—so choose one that supports growth, security, and peace.

Building a Sustainable System: Making Growth Stick

Short-term wins are exciting, but lasting financial improvement requires a system. I learned this the hard way—making progress for a few months, then slipping back when life got busy. The breakthrough came when I created a monthly financial review. Every month, I set aside time to track my income sources, review my expenses, evaluate my savings progress, and adjust my goals. This simple habit transformed sporadic efforts into consistent momentum.

During the review, I ask specific questions: Which income streams performed well? Where did I overspend? Are my savings on track? What adjustments do I need to make? This process helps me stay accountable and make informed decisions. I also use it to celebrate progress—no matter how small. Recognizing achievements keeps me motivated and reinforces positive behavior. Over time, this routine became automatic, like brushing my teeth. It didn’t take much time—usually less than an hour—but the impact was significant.

A sustainable system is flexible, not rigid. Life changes—kids grow, expenses shift, opportunities appear. My system evolved with me. I added new income categories, adjusted savings targets, and refined my risk rules. The goal isn’t perfection; it’s consistency with adaptability. Automation played a big role—setting up recurring transfers, bill payments, and investment contributions so that good habits happened without constant effort.

Sustainability also means protecting your energy. Financial management shouldn’t feel like a burden. I designed my system to fit my lifestyle, not the other way around. I chose tools that were simple and user-friendly, avoiding overly complex apps or methods that required constant monitoring. The system works for me, not against me. When growth is built into your routine, it becomes a natural part of life—not a chore you have to force. This is how progress becomes permanent.

Income Growth as a Lifelong Practice

Looking back, my journey wasn’t defined by a single breakthrough, but by a series of intentional choices. True income improvement isn’t about luck or privilege—it’s about financial literacy, disciplined habits, and the courage to try something new. You don’t need a six-figure salary to start building a better financial future. What you need is clarity about your goals, control over your decisions, and the willingness to adapt when things don’t go as planned.

The strategies that worked for me—tracking expenses, diversifying income, micro-saving, managing risk, stacking skills, shifting mindset, and building systems—are not magic formulas. They are practical, accessible tools that anyone can use. They require patience and consistency, but they don’t require perfection. What matters most is showing up, making small improvements, and staying the course.

Financial freedom isn’t just about having more money. It’s about having more choices—more time with family, more peace of mind, more ability to handle life’s uncertainties. It’s about creating a life where you feel in control, not overwhelmed. By focusing on sustainable methods, avoiding reckless risks, and valuing long-term growth over quick wins, you can build a future that reflects your values and priorities.

This journey isn’t over for me. It never really ends. Money, like life, is always changing. But now I have the tools and confidence to navigate it with purpose. And that makes all the difference. Your financial future isn’t determined by where you start—it’s shaped by the choices you make today. Start small. Stay consistent. Keep learning. The path to a stronger, more secure life begins with a single step—and it’s one you can take right now.