Why I Almost Lost It All: My Real Talk on Smarter Money Moves

I once thought financial planning was just about saving a little and investing somewhere. Then reality hit—hard. I jumped into opportunities without asking the right questions and almost wiped out my savings. That wake-up call taught me the true meaning of risk assessment. Now, I look at every decision through a filter: not just "Could this grow my money?" but "What’s the worst that could happen?" This is the shift that changed everything. It wasn’t a single catastrophic event but a series of small, overconfident choices that piled up. I had assumed that because one investment paid off, the next would too. I ignored warning signs, dismissed concerns, and convinced myself that risk was something that happened to other people. When the market shifted, I was left exposed—emotionally and financially. That experience reshaped my entire approach. Today, I focus not on chasing returns, but on building resilience. This is the story of how I learned to protect first, grow later—and how you can, too.

The Wake-Up Call: When My Plan Bleared Red

It started with a sense of momentum. A few early wins in the stock market gave me a false sense of confidence. I had invested in a technology fund that doubled in value within 18 months, and suddenly, I felt like I had cracked the code. That success became a dangerous narrative: if one bold move paid off, why not make another? I began to treat investing less like a disciplined strategy and more like a game of momentum. The turning point came when I redirected a large portion of my retirement savings into a single-sector ETF, heavily weighted in emerging biotech companies. At the time, the sector was gaining media attention, and analysts were optimistic. I told myself I was being strategic, not reckless. But in truth, I wasn’t evaluating risk—I was chasing excitement.

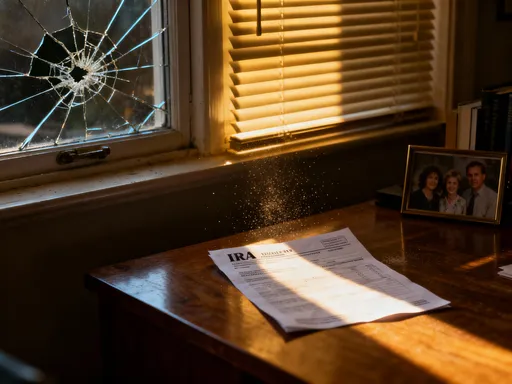

The unraveling was gradual at first. The fund held steady for several months, then began to dip. I told myself it was normal volatility. But when regulatory concerns surfaced around some of the key companies in the portfolio, the value dropped sharply—over 40% in just six weeks. My initial reaction was denial. I held on, convinced it would rebound. But as losses deepened, anxiety set in. I started checking my account daily, sometimes hourly. Sleep became difficult. The money I had invested wasn’t just numbers on a screen—it represented years of careful saving, my children’s future education fund, and a cushion for unexpected expenses. The emotional toll was as heavy as the financial one. I realized I had put everything at risk not because I lacked information, but because I had ignored it.

The moment of clarity came during a conversation with a financial advisor I had previously dismissed as too cautious. She asked a simple question: "If this investment went to zero, could you still meet your basic obligations?" I couldn’t answer yes. That honesty changed everything. I finally admitted I had overestimated my risk tolerance and underestimated the potential downside. I sold the position at a significant loss, but it was the right decision. The experience didn’t just cost me money—it cost me peace of mind. But from that loss came a valuable lesson: financial confidence isn’t built on big wins, but on the ability to withstand setbacks without collapsing. That near-loss became the foundation of a smarter, more sustainable approach to managing money.

What Risk Assessment Really Means (And Why It’s Not Just for Experts)

Risk assessment is often misunderstood as something complex, reserved for financial professionals with advanced degrees and access to sophisticated models. But in its essence, it’s a simple practice: asking what could go wrong before moving forward. It’s not about fear or avoiding all risk—it’s about awareness. Every financial decision carries uncertainty, and risk assessment is the tool that helps you navigate that uncertainty with clarity. For the average person, this doesn’t require complex calculations or jargon. It starts with honest questions: How much could I lose? How would that loss affect my life? Am I making this choice based on data or emotion? These are not expert-only considerations—they are essential for anyone who earns, saves, or invests money.

Think of risk assessment like wearing a seatbelt. You don’t wear it because you expect a crash; you wear it because you understand that accidents happen, even to careful drivers. Similarly, checking the weather before a trip doesn’t mean you’re afraid of rain—it means you’re prepared for it. Financial risk assessment works the same way. It’s not about predicting the future, but about preparing for a range of possible outcomes. When you assess risk, you shift from reacting to events as they unfold to anticipating them in advance. This proactive mindset reduces panic and increases control. It allows you to make decisions from a place of strength, not desperation.

One of the most important shifts is recognizing that risk is personal. Two people can look at the same investment and see different levels of risk—not because one is smarter, but because their financial situations and emotional capacities differ. A young professional with no dependents might comfortably accept short-term volatility for long-term growth. A parent nearing retirement with limited savings may need to prioritize stability over potential returns. Risk assessment helps you define your own boundaries. It’s not about copying what others do; it’s about understanding what you can truly afford to lose. When you internalize this, financial decisions become less about chasing trends and more about aligning with your real-life needs.

The Hidden Traps in Common Financial Plans

Many people believe they have a solid financial plan simply because they’re saving regularly or contributing to a retirement account. But good intentions aren’t enough. Common financial strategies often contain hidden vulnerabilities that only become apparent when markets turn or life circumstances change. One of the most frequent mistakes is overconcentration—placing too much of a portfolio in a single asset, sector, or even employer stock. This creates a false sense of security. As long as the asset performs well, everything seems fine. But when it declines, the impact is magnified because there’s no buffer. Diversification isn’t just a suggestion; it’s a fundamental protection against unexpected shocks.

Another trap is ignoring time horizons. People often invest with short-term goals in mind but use long-term strategies, or vice versa. For example, saving for a home down payment in three years using a high-growth stock portfolio exposes the plan to unnecessary risk. Market fluctuations over a short period can erase gains, making it harder to reach the goal. Conversely, someone saving for retirement decades away might play it too safe, keeping most of their money in low-yield savings accounts, missing out on the power of compound growth. Aligning investment choices with the timing of financial goals is critical. A mismatch can silently erode progress, even if the account balance appears stable.

Liquidity is another overlooked factor. Some investments are difficult to convert to cash quickly without incurring penalties or losses. A person might have a large balance in a retirement account, but if an emergency arises, accessing those funds early could mean taxes, fees, and long-term consequences. Assuming that all money is equally accessible can lead to dangerous gaps in financial resilience. Additionally, lifestyle expectations can inflate risk without awareness. Planning for a certain standard of living in retirement without accounting for inflation, healthcare costs, or unexpected expenses creates a fragile financial structure. These hidden traps don’t announce themselves—they accumulate quietly, only revealing their impact when it’s too late to reverse course.

How to Map Your Personal Risk Threshold

Understanding your personal risk threshold is one of the most important steps in building a sound financial plan. It’s not just about how you feel when the market drops—it’s about what your financial situation can realistically withstand. Risk tolerance has two components: emotional and financial. The emotional side is how much volatility you can handle without panic-selling or losing sleep. The financial side is whether your balance sheet can absorb a loss without derailing essential goals. Both matter, but the financial aspect is what ultimately determines your true risk capacity.

To map your threshold, start by evaluating your stability needs. How reliable is your income? Do you have a stable job, or are you in a fluctuating industry? Next, assess your emergency reserves. Do you have three to six months of living expenses saved in accessible accounts? This cushion acts as a shock absorber, allowing you to avoid selling investments at a loss during downturns. Then, consider upcoming large expenses—college tuition, home repairs, medical costs. These obligations reduce the amount of risk you can afford to take because the money must be available when needed.

A useful exercise is to simulate a 20% market drop and ask: Would this prevent me from meeting my essential needs? If the answer is yes, your portfolio may be too aggressive. On the other hand, if you have strong income, ample savings, and distant goals, you may be able to take on more risk to pursue growth. But this isn’t a one-time assessment. Life changes—marriage, children, job changes, health issues—all affect your risk capacity. Revisiting your threshold annually, or after major life events, ensures your financial plan stays aligned with reality. This ongoing evaluation is what separates reactive decision-making from proactive planning.

Smart Diversification: More Than Just “Don’t Put All Eggs in One Basket”

Diversification is one of the most repeated pieces of financial advice, yet it’s often misunderstood. Saying “don’t put all your eggs in one basket” is accurate, but incomplete. The real question is: what kind of eggs, and what kind of baskets? True diversification means spreading investments across different asset classes—stocks, bonds, real estate, cash—that respond differently to economic conditions. When stocks fall during a recession, bonds may hold steady or even rise. Real estate might decline in one region but grow in another. This lack of correlation reduces overall portfolio volatility. The goal isn’t to eliminate risk, but to smooth out the ride over time.

Yet many people fall into the trap of “fake diversification.” They own multiple funds or stocks, but all within the same sector or region. For example, holding five different tech stocks doesn’t protect you when the entire tech industry faces a downturn. Similarly, investing in multiple international funds that all track developed markets misses the benefit of true geographic spread. Real diversification includes exposure to different economies, currencies, and market cycles. It also considers time—dollar-cost averaging, for instance, spreads purchases over time, reducing the risk of buying at a peak.

Another dimension is investment style. Mixing growth-oriented assets with value-based or income-generating ones adds balance. A retiree might pair dividend-paying stocks with high-quality bonds to create a steady income stream with lower volatility. A younger investor might combine aggressive growth funds with stable index funds to capture upside while limiting exposure. The key is intentionality. Diversification shouldn’t be random—it should reflect your goals, timeline, and risk capacity. When done right, it’s not just a safety net; it’s a strategic framework that allows you to stay invested through market cycles, compounding gains over decades.

Tools That Actually Help—And Which Ones to Skip

In today’s digital age, a wealth of tools promises to simplify financial planning and risk assessment. Some are genuinely helpful; others create a false sense of security. Budget trackers, for example, are highly effective when used consistently. They provide a clear picture of income, spending, and savings patterns, helping you identify areas where you can build emergency reserves. Scenario planners are another valuable resource. These tools allow you to model different financial outcomes—what happens if the market drops 20%? What if you lose income for six months? Seeing these possibilities in advance reduces panic when real challenges arise.

Stress-test calculators, often offered by financial institutions, can also be useful. They simulate how your portfolio might perform under adverse conditions, such as rising interest rates or inflation spikes. The key is to understand the assumptions behind these tools. Are they using historical data? Are they accounting for your specific tax situation? Blindly trusting a tool’s output without questioning its inputs can lead to poor decisions. For example, an automated investment app might assign you a “moderate” risk portfolio based on a short questionnaire, but it may not consider your upcoming mortgage payment or your child’s college tuition.

Some tools should be approached with caution. Apps that promise high returns with low risk often oversimplify complex markets. Robo-advisors can be convenient, but they may not adapt quickly to personal life changes. And while artificial intelligence is improving, it still lacks the nuance of human judgment in times of crisis. The best approach is to use tools as assistants, not replacements. Let them handle data and projections, but keep the final decision in your hands. Pair technology with personal review—schedule quarterly check-ins to assess whether your plan still aligns with your goals. This balanced use of tools enhances clarity without surrendering control.

Building a Plan That Protects First, Grows Later

The most sustainable financial plans are built on a simple principle: protect first, grow later. This means prioritizing capital preservation over aggressive returns, especially when stability is critical. The foundation of this approach is a strong emergency fund—enough to cover essential expenses for several months, kept in a liquid, low-risk account. This buffer allows you to avoid selling investments during downturns, which often locks in losses. From there, the focus shifts to debt management. High-interest debt, like credit card balances, erodes wealth over time. Paying it down is one of the most reliable ways to improve financial health, effectively earning a risk-free return equal to the interest rate.

Next comes structured investing. Instead of chasing hot trends, a protection-first plan uses disciplined strategies like dollar-cost averaging and asset allocation. These methods reduce timing risk and keep emotions in check. It also includes clear exit rules—predefined conditions for selling an investment, such as a 15% loss or a fundamental change in the company’s outlook. These rules prevent emotional decisions during market swings. Success is defined not by beating the market, but by staying on track with personal goals. Regular check-ins—quarterly or semi-annually—allow for adjustments based on life changes, not market noise.

This approach may seem conservative, but it’s designed for longevity. Markets go up and down, but a well-structured plan keeps you invested through both. It accepts that growth takes time and that setbacks are inevitable. The goal isn’t to win big in a single year, but to avoid catastrophic losses that derail decades of progress. By focusing on protection, you build the resilience needed to stay in the game long enough to benefit from compounding. Over time, this consistency outperforms short-term gambles, delivering steady, reliable results.

Conclusion: Confidence Isn’t About Winning Big—It’s About Staying in the Game

Looking back, the biggest shift in my financial life wasn’t finding the perfect investment or timing the market. It was changing my mindset—from chasing gains to managing risk. That single change brought more peace of mind than any short-term win ever did. True financial confidence doesn’t come from how much you make, but from how well you can withstand loss. It’s the quiet assurance that even if things go wrong, you won’t be knocked off course. This kind of security isn’t glamorous, but it’s powerful. It allows you to make decisions calmly, without panic or desperation.

Risk assessment isn’t a barrier to wealth—it’s the foundation of lasting control. It transforms money from a source of anxiety into a tool for freedom. When you know your limits, diversify wisely, and build safeguards, you’re no longer gambling. You’re planning. And that planning creates space for your family, your dreams, and your future. The goal isn’t to avoid all risk, but to take smart, informed risks that align with your life. In the end, the most successful financial journey isn’t measured by peak balances, but by the ability to keep moving forward—no matter what the market throws your way.