The Hidden Cost of Grad School: What No One Tells You About the Investment

You’re excited about grad school—better career, higher salary, personal growth. But have you really looked at the full price tag? It’s not just tuition. I’ve seen too many people jump in without understanding the financial ripple effects. What does it really cost? And is it worth it in today’s job market? This isn’t just about debt—it’s about timing, opportunity cost, and long-term payoff. Let’s unpack the real economics behind graduate education. While the idea of advancing your knowledge and qualifications feels empowering, the financial reality for many graduates is far more complicated than admissions brochures suggest. The decision to pursue a graduate degree should be treated not just as an academic choice, but as a significant financial commitment—one that can shape your economic well-being for decades.

The Real Price Tag Beyond Tuition

When most people consider the cost of graduate school, they focus on tuition alone. A program might advertise a price of $30,000 per year, leading students to believe the total cost is around $60,000 for a two-year degree. But this narrow view ignores a much broader financial picture. The true cost of graduate education includes not only tuition but also living expenses, books and supplies, health insurance, transportation, and, critically, the income you forgo by not working full-time during your studies. These combined factors can double—or even triple—the apparent price of enrollment.

Take housing, for example. In major urban centers where many top graduate programs are located, rent alone can exceed $1,500 per month. Add groceries, utilities, transportation, and personal expenses, and monthly living costs can easily surpass $2,500. Over two years, that’s an additional $60,000 in out-of-pocket spending—on top of tuition. Then there are academic fees, lab supplies, conference travel, and technology needs, all of which add up quickly. Health insurance, often not fully covered by universities, can cost several hundred dollars per month, especially if dependents are involved.

Perhaps the most overlooked component is opportunity cost—the earnings you give up while studying. If you were making $60,000 annually in a full-time job before enrolling, stepping away for two years means forgoing $120,000 in income, not including raises, bonuses, or retirement contributions. Even part-time work during school rarely compensates for this gap. When you combine direct costs with lost wages, the total financial burden of a graduate degree can exceed $200,000 for many students—far beyond what they initially budgeted. This full accounting is essential for making informed decisions, yet it’s rarely discussed in promotional materials or financial aid sessions.

Graduate Degrees in Today’s Job Market: Demand vs. Reality

The assumption that a graduate degree automatically leads to better job prospects and higher pay doesn’t always hold true in today’s economy. While certain fields continue to reward advanced education with strong employment outcomes, others face oversaturation, stagnant salaries, or declining demand. Understanding where your degree fits within current labor market trends is critical to evaluating its long-term value.

Fields like engineering, computer science, data analytics, and healthcare—particularly nursing, physical therapy, and physician assistant roles—consistently show high return on investment. These professions often require advanced credentials for licensure and offer median salaries well above national averages. For instance, a master’s in data science can lead to roles with starting salaries exceeding $100,000 in major tech hubs. Similarly, advanced degrees in healthcare frequently come with strong job placement rates and clear career progression paths.

On the other hand, degrees in the humanities, social sciences, fine arts, and some areas of business administration often struggle to deliver proportional financial returns. Many of these programs produce more graduates than available positions, leading to fierce competition for limited roles. A 2023 report from the Federal Reserve Bank of New York found that nearly 40% of graduate degree holders in liberal arts and social sciences were underemployed—working in jobs that do not require a master’s degree. In some cases, individuals with advanced degrees in these areas earn only marginally more than those with bachelor’s degrees, making the financial sacrifice harder to justify.

Geographic location also plays a role in employability. A degree in urban planning may open doors in cities with active infrastructure projects but offer fewer opportunities in rural regions. Likewise, specialized degrees in international relations or nonprofit management often concentrate employment in specific hubs like Washington, D.C., or New York, limiting geographic flexibility. The mismatch between where graduates live and where jobs are available can further erode the value of a degree. Therefore, assessing both field-specific demand and regional labor conditions is crucial before committing to a program.

Debt Load and Repayment: When the Numbers Start to Bite

Many students rely on federal and private loans to finance graduate education, often underestimating how quickly debt accumulates and how long repayment will take. Unlike undergraduate borrowing limits, graduate students can borrow up to the full cost of attendance through federal Direct Unsubsidized Loans and Grad PLUS Loans. While this access provides flexibility, it also enables borrowing levels that can become unmanageable, especially when combined with existing undergraduate debt.

Consider a student who takes out $150,000 in loans over two years. At a 6.8% interest rate—the standard for Grad PLUS Loans—the monthly payment under a standard 10-year repayment plan would be approximately $1,730. That’s nearly $21,000 per year in debt service alone. For someone entering a public interest field like social work or education, where starting salaries may range from $45,000 to $60,000, such payments represent a significant portion of take-home income. Even with income-driven repayment plans that cap payments at 10% to 20% of discretionary income, the loan balance can grow due to unpaid interest, particularly during periods of low earnings or deferment.

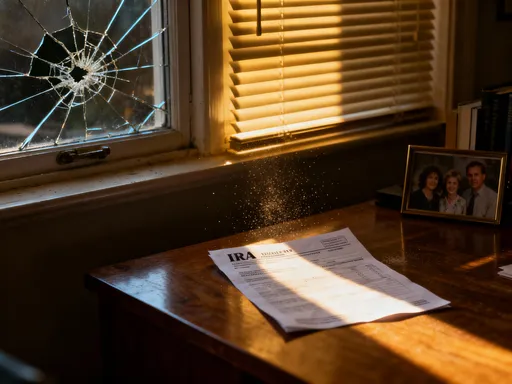

The psychological impact of long-term debt should not be underestimated. Studies have shown that individuals with high student loan balances experience greater financial stress, delayed life milestones, and reduced confidence in their financial future. Many postpone buying homes, starting families, or saving for retirement because of ongoing loan obligations. Some report feeling trapped in higher-paying jobs they dislike simply to meet repayment requirements, limiting career flexibility and personal fulfillment.

Additionally, forgiveness programs like Public Service Loan Forgiveness (PSLF) offer hope but come with strict eligibility rules and administrative hurdles. Only about 3% of applicants have successfully received forgiveness under PSLF since its inception, often due to documentation errors or employer classification issues. Relying on forgiveness without a backup plan introduces substantial risk. Therefore, borrowers must approach student loans with caution, treating them not as free money but as long-term liabilities that will shape their financial decisions for years to come.

Alternative Paths That Skip the Debt Trap

Graduate school is not the only path to career advancement or skill development. In recent years, alternative education models have gained credibility and acceptance across industries, offering high-value training without the burden of six-figure debt. Certifications, bootcamps, apprenticeships, and employer-sponsored programs now provide viable routes into well-paying, in-demand careers—often in less time and at a fraction of the cost.

For example, coding bootcamps such as General Assembly, Flatiron School, or Springboard offer intensive training in software development, data analysis, and cybersecurity, typically lasting 12 to 24 weeks and costing between $10,000 and $20,000. Graduates frequently secure entry-level tech roles with salaries comparable to those of master’s degree holders, particularly in startups and mid-sized companies that prioritize skills over formal credentials. Many bootcamps also offer income-share agreements, allowing students to pay tuition only after securing a job, aligning incentives and reducing upfront risk.

Professional certifications are another powerful alternative. In fields like project management (PMP), information technology (CompTIA, AWS, CISSP), digital marketing (Google Analytics, HubSpot), and financial planning (CFP), certifications carry significant weight and are often preferred or required by employers. These programs typically cost between $500 and $3,000 and can be completed part-time while working. The return on investment is often immediate, with certified professionals seeing salary increases of 10% to 30% within a year of earning their credentials.

Apprenticeships and fellowships are also gaining traction, especially in healthcare, skilled trades, and public service. Registered nursing apprenticeships, for instance, allow individuals to earn while they learn, combining classroom instruction with paid clinical experience. Similarly, government and nonprofit fellowships—such as the Presidential Management Fellowship or AmeriCorps VISTA—provide leadership training, networking opportunities, and career placement support without requiring tuition payment. These pathways emphasize practical experience, mentorship, and job readiness, making them attractive options for those seeking advancement without debt accumulation.

Investing in Yourself: Is It Still a Smart Move?

Education is often described as one of the best investments you can make in yourself. And in many cases, that’s true. But like any financial decision, it should be evaluated using sound principles: expected return, risk assessment, time horizon, and opportunity cost. Viewing graduate school through an investment lens helps shift the conversation from emotional desire to strategic analysis.

The concept of return on investment (ROI) is particularly useful. ROI measures the financial benefit of a degree relative to its cost. For example, if a program costs $80,000 and leads to a salary increase of $20,000 per year, the breakeven point is four years. However, if the same program costs $150,000 and results in only a $5,000 raise, the payoff period extends to 30 years—making it a much riskier proposition. ROI varies widely by field, institution, and individual circumstance, so blanket assumptions are misleading.

Risk-adjusted returns are equally important. A degree in a volatile or oversupplied field may offer high potential rewards but comes with greater uncertainty. Conversely, a credential in a stable, high-demand sector may provide modest but reliable gains. Diversification also applies: just as you wouldn’t put all your savings into a single stock, you shouldn’t assume one degree will guarantee financial security. Building a portfolio of skills—through a mix of formal education, certifications, and work experience—often yields better long-term outcomes than relying solely on a single graduate credential.

Geographic mobility, school reputation, and alumni networks also influence outcomes. Graduating from a well-regarded program in a region with strong industry ties can significantly boost job placement and earning potential. However, prestige alone doesn’t guarantee success. Many employers now prioritize demonstrated competencies, portfolios, and real-world experience over institutional pedigree. Therefore, the value of a degree depends not just on where you earn it, but how you leverage it in the job market.

Strategies to Minimize Risk and Maximize Value

If you decide that graduate school is the right step for your goals, there are proven strategies to reduce financial risk and enhance the value of your investment. The key is to approach enrollment with the same diligence you would apply to any major purchase or business decision—researching options, negotiating terms, and planning for long-term outcomes.

One of the most effective ways to lower costs is to seek fully funded programs. Many research-based master’s and doctoral degrees, particularly in STEM and social sciences, offer tuition waivers and stipends in exchange for teaching or research assistantships. These positions not only eliminate tuition but also provide a living allowance, allowing students to graduate debt-free. While competitive, these opportunities are more common than many applicants realize, especially at public universities and research institutions.

Another strategy is to choose lower-cost institutions without sacrificing quality. Regional public universities often charge significantly less than private or Ivy League schools but still offer strong academic training and career support. Online programs from accredited institutions can also reduce expenses by eliminating relocation and commuting costs. Some schools even offer in-state tuition rates for online learners regardless of residency, making them accessible to a broader audience.

Negotiating funding packages is another underutilized tactic. If you’re accepted to multiple programs, use competing offers to request additional scholarships or assistantships. Many departments have discretionary funds and are willing to improve offers to attract strong candidates. Additionally, applying early, seeking external fellowships (such as those from professional associations or foundations), and leveraging employer tuition reimbursement programs can further reduce out-of-pocket costs.

Timing matters, too. Enrolling during periods of economic downturn may reduce opportunity cost if job prospects are limited anyway. Conversely, entering the workforce first and gaining experience before returning to school can strengthen applications, clarify career goals, and allow for savings accumulation. Some professionals complete graduate degrees part-time while working, spreading costs over time and maintaining income flow. Each approach has trade-offs, but careful planning can align education with financial stability.

Long-Term Wealth Building: Where Grad School Fits In

Ultimately, the decision to pursue graduate school should be viewed within the context of lifelong financial health. A degree is not an isolated event but a factor that influences savings rates, homeownership timelines, retirement planning, and overall net worth. For some, it accelerates wealth accumulation by opening doors to higher-earning roles. For others, it delays financial independence due to debt and lost earning years.

Research from the Federal Reserve and Bureau of Labor Statistics shows that, on average, graduate degree holders earn more over their lifetimes than those with only a bachelor’s degree. However, this gap narrows significantly when debt and delayed earnings are factored in. A 2022 study found that while master’s degree holders earned about 20% more annually, it took nearly 15 years to recoup the total cost of attendance when opportunity cost and loan interest were included. For professional degrees like law or medicine, the breakeven point can extend to 20 years or more.

Moreover, early career savings have a compounding effect. The money not saved during graduate school—due to low income or high expenses—represents lost growth potential. A person who starts saving $5,000 per year at age 25 could accumulate over $500,000 by age 65 with a 6% annual return. Delaying those contributions until age 30 reduces the final balance by nearly $100,000. This illustrates how the timing of education can indirectly impact long-term wealth, even if income eventually rises.

Therefore, the best financial decisions balance short-term sacrifice with long-term gain. For individuals entering high-demand, well-compensated fields, graduate school often makes sense as a strategic investment. For others, particularly those in lower-paying sectors or uncertain job markets, alternative pathways may offer better financial outcomes. The goal is not to reject advanced education, but to pursue it wisely—aligning ambition with economic reality, and ensuring that the pursuit of knowledge does not come at the expense of financial security.