Mindset Over Money: How I Stopped Chasing Returns and Started Building Wealth

Investing used to stress me out—watching markets, jumping on trends, feeling guilty for not "making enough." Then I realized: the real game isn’t about picking winners, it’s about managing yourself. Most beginners overlook the psychology behind asset allocation, focusing only on numbers. But emotions like fear, greed, and impatience can wreck even the smartest strategy. This is the shift that changed everything for me—and what I wish I’d known from day one. The path to lasting wealth isn’t paved with hot stock tips or market timing, but with emotional discipline, self-awareness, and a long-term perspective. What follows is not just a guide to smarter investing, but a roadmap to becoming the kind of investor who thrives—not because they predict the future, but because they understand themselves.

The Hidden Cost of Emotional Investing

Emotional investing is one of the most expensive habits an individual can develop, yet it often goes unnoticed. Many new investors measure success solely by returns, believing that high gains mean they’re making smart choices. In reality, emotional decisions—such as buying into a rising market out of excitement or selling during a downturn out of fear—frequently lead to buying high and selling low, the exact opposite of what sound strategy recommends. This pattern is not rare; it is widespread. Studies have shown that the average individual investor underperforms the market over time, not because of poor stock selection, but because of poor timing driven by emotion. The gap between the returns of a passive index fund and the actual returns experienced by the average investor is often referred to as the “behavior gap,” and it can amount to several percentage points lost annually. That difference may seem small, but over decades, it translates into tens or even hundreds of thousands of dollars in missed growth.

Fear and greed are the two dominant forces behind emotional investing. Fear takes hold when markets dip, prompting investors to sell in an attempt to avoid further losses. Yet, historically, markets have recovered from every downturn, and those who stay invested benefit from the rebound. Selling during a decline locks in losses and removes the opportunity to participate in the recovery. On the other hand, greed drives investors to chase performance—buying into assets that have already surged in value, often at their peak. This is commonly seen during investment fads, such as speculative technology bubbles or cryptocurrency spikes. When the excitement fades and prices correct, those who bought at the top are left with significant losses. These emotional reactions are amplified by constant media coverage, social media chatter, and the 24-hour news cycle, all of which create a sense of urgency that contradicts the patient nature of successful wealth building.

One of the most insidious emotional traps is FOMO—fear of missing out. It manifests when an investor sees others profiting from a particular stock or trend and feels compelled to join in, regardless of whether it aligns with their goals or risk tolerance. This often leads to impulsive decisions made without research or strategy. Similarly, overconfidence after a few successful trades can create a false sense of skill, encouraging riskier bets. Both behaviors ignore the randomness inherent in short-term market movements and assume a level of control that simply does not exist. The reality is that no one consistently predicts market turns, and even professional investors struggle to time the market accurately. Therefore, the most effective defense against emotional investing is not better information, but better self-management. Recognizing emotional triggers and creating systems to prevent reactive behavior is the first and most critical step toward sustainable financial success.

Asset Allocation as a Safety Net, Not a Math Problem

When most people think about investing, they imagine selecting individual stocks or chasing high-performing funds. But the foundation of long-term success lies not in stock picking, but in asset allocation—the strategic division of investments across different categories such as stocks, bonds, and cash. While it may sound like a technical exercise in number crunching, asset allocation is, in practice, a behavioral tool designed to protect investors from themselves. A well-structured portfolio doesn’t promise the highest possible returns; instead, it aims to deliver steady growth while minimizing the emotional temptation to abandon the plan during turbulent times. In this sense, asset allocation functions like a financial seatbelt—it won’t prevent every bump, but it dramatically reduces the risk of serious harm when the market takes an unexpected turn.

The core idea behind asset allocation is diversification: spreading investments across different asset classes that respond differently to market conditions. For example, when stock markets decline, bonds often hold their value or even increase, helping to cushion the overall portfolio. Cash provides liquidity and stability, allowing investors to avoid selling investments at a loss during downturns. By combining these elements, a balanced portfolio reduces volatility and creates a smoother investment experience. This stability is crucial because it enables investors to stay the course. When a portfolio swings wildly in value, even disciplined individuals may feel pressured to act, often at the worst possible time. A diversified allocation reduces those swings, making it easier to maintain composure and adhere to long-term goals.

Many investors make the mistake of viewing asset allocation as a one-time decision or a formula to be optimized for maximum returns. In reality, it should be seen as a dynamic framework that reflects personal circumstances, goals, and emotional capacity. A young investor with a long time horizon might tolerate more stock exposure, while someone nearing retirement may prioritize income and capital preservation through bonds and cash. The key is not to achieve the “perfect” mix, but to create a structure that aligns with both financial objectives and psychological comfort. If an allocation causes constant anxiety, it is too aggressive, regardless of what the textbooks suggest. Conversely, if it feels too conservative and leads to impatience or boredom, adjustments may be needed. The goal is consistency over time, not short-term performance. By treating asset allocation as a safety net rather than a performance engine, investors free themselves from the pressure of constant optimization and focus instead on what truly matters: long-term progress.

Why “Boring” Portfolios Win in the Long Run

In a world that celebrates quick wins and overnight success, a “boring” investment strategy can feel unsatisfying. There is little excitement in watching a diversified portfolio grow steadily at 6% to 8% per year when headlines tout 50% gains in speculative assets. Yet, history shows that it is precisely this steady, uneventful approach that builds lasting wealth. The markets do not reward drama; they reward patience, consistency, and compounding. A portfolio of low-cost index funds, balanced across asset classes, may never make the front page, but it consistently outperforms the majority of actively managed funds and individual stock pickers over time. The reason is simple: while flashy investments capture attention, they often carry hidden risks and high costs that erode returns. In contrast, a disciplined, diversified strategy avoids the pitfalls of emotion and overconfidence, allowing compound growth to work uninterrupted.

Consider the story of two neighbors: one who proudly announces his latest stock purchase after hearing about it on a financial podcast, and another who quietly contributes to a balanced portfolio every month. The first may enjoy short-term gains and social validation, but when the market corrects, he often sells in panic, locking in losses. The second, though less visible, continues investing regardless of market noise. Over time, the quiet investor’s portfolio grows not because of any single brilliant decision, but because of consistent behavior. This is the power of compounding—small, regular gains build upon one another, creating exponential growth over decades. A 7% annual return may seem modest in a single year, but over 30 years, it turns a $10,000 investment into more than $76,000. That kind of result doesn’t require genius; it requires discipline and the willingness to ignore the noise.

Another reason “boring” portfolios succeed is their low cost. High-fee funds, frequent trading, and speculative investments all eat into returns. Even a 1% difference in annual fees can reduce final wealth by 20% or more over a lifetime of investing. Index funds and ETFs, which track broad market indices, typically have much lower expense ratios than actively managed funds. They also eliminate the risk of underperformance due to poor management decisions. While they won’t beat the market, they ensure that investors capture market returns without unnecessary drag. This is not to say that all risk should be avoided—equities are essential for growth over time—but that risk should be intentional, measured, and aligned with long-term goals. The investor who chases the next big thing is often reacting to past performance, not future potential. The disciplined investor, by contrast, focuses on what they can control: saving consistently, minimizing costs, and staying diversified. In the long run, these habits matter far more than any single investment decision.

Building Your Financial Identity

Every investor brings a unique set of beliefs, experiences, and emotions to their financial decisions. These factors shape what can be called a financial identity—the internal framework that guides how a person views money, risk, and success. For some, money represents security and freedom; for others, it carries guilt or anxiety. These emotional associations are not trivial—they directly influence investment behavior. Someone raised in a household where money was scarce may be overly cautious, avoiding risk even when it is appropriate. Another person who experienced early success in the market may become overconfident, taking on excessive risk without realizing it. Understanding your financial identity is not a luxury; it is a necessity for making sound investment choices. Without self-awareness, even the best strategy can fail because it does not align with the investor’s true nature.

To build financial self-awareness, it helps to reflect on key questions: How do I react when my portfolio loses value? Do I feel anxious, or am I able to stay calm? What does financial success mean to me—retiring early, supporting my family, leaving a legacy? Have I ever made an impulsive investment based on emotion? These questions are not about finding right or wrong answers, but about uncovering patterns in thinking and behavior. Journaling about financial decisions, tracking emotional responses to market changes, or discussing money with a trusted advisor can all deepen this understanding. Some investors benefit from formal risk tolerance assessments, which use questionnaires to gauge comfort with volatility and loss. While not perfect, these tools provide a starting point for aligning investments with personality.

Recognizing emotional triggers is a critical part of this process. For example, an investor who feels compelled to check their portfolio daily may be driven by a need for control or fear of missing out. Someone who avoids reviewing their investments altogether might be avoiding discomfort or denial. Both behaviors can be problematic. The goal is not to eliminate emotions—this is neither possible nor desirable—but to recognize them and create systems that prevent them from driving decisions. A personalized investment plan should reflect not just financial goals, but emotional realities. If a portfolio causes constant stress, it is too aggressive. If it feels too safe and leads to boredom or restlessness, it may not support long-term growth. The ideal balance allows an investor to stay engaged without being overwhelmed. By building a financial identity rooted in honesty and self-knowledge, investors create a foundation for decisions that are not only logical, but sustainable.

Practical Steps to Align Behavior with Strategy

Knowledge alone does not lead to better investing. Many people understand the principles of diversification, low costs, and long-term thinking, yet still make emotional decisions when markets turn volatile. The missing ingredient is not information, but habit. Sustainable wealth is built not through occasional brilliance, but through consistent, repeatable actions. This is why systems and routines are more powerful than willpower. By creating automatic processes and behavioral guardrails, investors can reduce the influence of emotion and stay aligned with their long-term strategy. The goal is to design an investment approach that works even when motivation fades or stress increases.

One of the most effective habits is setting up automatic contributions. By scheduling regular transfers from a checking account to an investment account, individuals ensure that saving happens consistently, regardless of market conditions or mood. This practice, known as dollar-cost averaging, also reduces the risk of investing a large sum at a market peak. Over time, it smooths out purchase prices and builds discipline. Another key habit is limiting portfolio reviews. Checking investments daily or even weekly increases exposure to short-term noise and amplifies emotional reactions. Instead, scheduling quarterly or semi-annual reviews creates space for thoughtful evaluation without constant interference. During these reviews, investors can assess progress, rebalance if needed, and adjust contributions—but only on a structured timeline, not in response to headlines.

Creating a “no-panic” rule is another powerful tool. This self-imposed policy might state: “I will not sell any investments during a market decline of less than 20%.” Such a rule provides clarity in moments of fear and prevents impulsive decisions. It is most effective when established during calm periods, not in the heat of a crisis. Similarly, writing down long-term goals and keeping them visible—such as on a refrigerator or in a journal—helps maintain focus when emotions run high. Other practical steps include working with a financial advisor for accountability, using simple investment vehicles to reduce complexity, and avoiding speculative accounts that encourage trading. The aim is not to eliminate risk, but to manage it in a way that supports both financial objectives and emotional well-being. When behavior and strategy are aligned, investing becomes less stressful and more effective.

The Role of Time, Not Timing

One of the most persistent myths in investing is that success depends on timing the market—buying low and selling high at precisely the right moments. In reality, even the most experienced professionals fail to do this consistently. Market movements are influenced by countless unpredictable factors, from economic data to geopolitical events to investor sentiment. Attempting to predict these shifts is not only difficult, but often counterproductive. Studies have shown that missing just a few of the best-performing days in the market can drastically reduce long-term returns. For example, an investor who stayed fully invested in the S&P 500 from 1993 to 2023 would have achieved strong growth, but one who missed the 10 best days during that period would have earned significantly less. The lesson is clear: staying invested matters more than trying to time entries and exits.

Time in the market is far more valuable than timing the market. This principle emphasizes the power of compounding and consistency. When money is invested regularly—through both bull and bear markets—it benefits from the full cycle of growth. Downturns, while uncomfortable, often present buying opportunities at lower prices. Investors who continue contributing during these periods acquire more shares for the same dollar amount, a process known as dollar-cost averaging. Over time, this leads to a lower average cost per share and higher overall returns. The key is not to avoid volatility, but to accept it as a normal part of the process. Market fluctuations are not a sign of failure; they are a feature of investing in growth assets.

Starting early is one of the greatest advantages an investor can have. Thanks to compounding, money invested in a person’s 20s or 30s has decades to grow, even with modest returns. A $300 monthly investment earning 7% annually would grow to over $500,000 in 30 years. The same investment started 10 years later would yield less than half that amount. This is not a call to perfection, but a reminder that consistency matters more than size. Even small, regular contributions made over a long period can lead to significant wealth. The most powerful tool an investor possesses is not a stock tip or a financial model—it is time. By focusing on time rather than timing, investors shift their attention from what they cannot control to what they can: their commitment to the process.

Staying the Course When It Feels Wrong

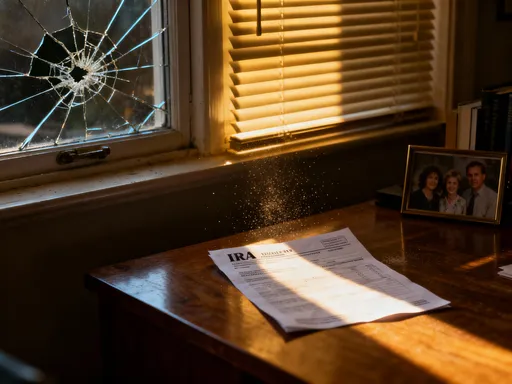

There will be times when staying invested feels like the wrong decision. Markets will fall, headlines will scream crisis, and fear will spread. In those moments, the instinct to act—especially to sell and “wait for stability”—can be overwhelming. Yet history shows that the most damaging investment decisions are often made during periods of peak fear. Every major market downturn—from the dot-com crash to the 2008 financial crisis to the 2020 pandemic sell-off—was followed by a recovery. Investors who remained patient and stayed the course not only preserved their capital but benefited from the rebound. Those who sold in panic locked in losses and missed the subsequent gains. Resilience in investing is not about being fearless; it is about trusting a well-constructed plan even when emotions suggest otherwise.

Preparing for these moments in advance increases the likelihood of making rational choices. This includes having a written investment plan that outlines goals, asset allocation, and rules for rebalancing. It also means understanding that volatility is not the same as loss—paper declines only become real losses when investments are sold. Building an emergency fund in cash or short-term bonds ensures that unexpected expenses do not force the sale of long-term investments at inopportune times. Additionally, focusing on what is within control—such as saving rate, costs, and diversification—helps maintain perspective during uncertainty. When the market is falling, it can be helpful to revisit past recoveries and remind oneself that downturns are temporary, even if they do not feel that way in the moment.

Staying the course also requires reframing how success is measured. Short-term performance is largely random and influenced by factors beyond individual control. Long-term success, however, is determined by behavior—by the ability to remain disciplined, patient, and focused. Investors who treat market downturns as normal and expected are less likely to react emotionally. They understand that wealth is built in the background, quietly, over years and decades. The most powerful investment tool is not a stock picker or an algorithm, but the human capacity for self-control. By preparing mentally and structurally for difficult times, investors can transform periods of fear into opportunities for long-term gain.

Wealth Is What You Don’t See

True financial success is often invisible. It does not come from viral stock picks, overnight windfalls, or dramatic market calls. It comes from quiet, consistent habits—automated savings, regular investing, disciplined rebalancing, and emotional resilience. The most successful investors are not those who make the most noise, but those who stick to a plan through market cycles, life changes, and emotional challenges. Wealth is not measured by the excitement of a single year’s return, but by the steady growth of a portfolio over decades. It is found in the peace of mind that comes from knowing you are on track, in the freedom that financial stability provides, and in the ability to support your family and values without constant worry.

The mindset shift—from chasing returns to managing behavior—is the real key to building wealth. Markets will always be unpredictable, but self-awareness and discipline are within reach. By focusing on what can be controlled—savings rate, costs, diversification, and emotional responses—investors gain a powerful advantage. This is not a get-rich-quick strategy; it is a get-rich-slow, stay-rich approach. It requires patience, humility, and a willingness to ignore the noise. But for those who commit to it, the rewards are profound. In the end, wealth is not about having more money than others—it is about living with intention, security, and purpose. And that kind of success is not just measurable; it is meaningful.