Why Market Smarts Beat Timing in Fund Investing

You don’t need to predict the market to win at fund investing—but you do need to understand it. I used to chase trends, panic during dips, and miss long-term gains. Then I shifted focus: from guessing to analyzing. This isn’t about getting rich quick. It’s about staying steady, thinking clearly, and letting discipline outperform emotion. Here’s how smarter market analysis transforms routine fund investing into a powerful wealth-building strategy.

The Myth of Perfect Timing—and Why It Fails Most Investors

Many investors believe that success in fund investing hinges on timing the market—buying just before prices rise and selling before they fall. This idea is deeply embedded in popular financial thinking, often glamorized by media stories of sudden windfalls. In reality, even the most experienced professionals struggle to consistently predict market movements. Studies have repeatedly shown that missing just a few of the best-performing days in the market can significantly reduce long-term returns. For example, research from major financial institutions indicates that an investor who remained fully invested in a broad market index over a 20-year period would have achieved substantially higher returns than one who missed the top 10 best days during that span—returns that often come in volatile clusters following downturns.

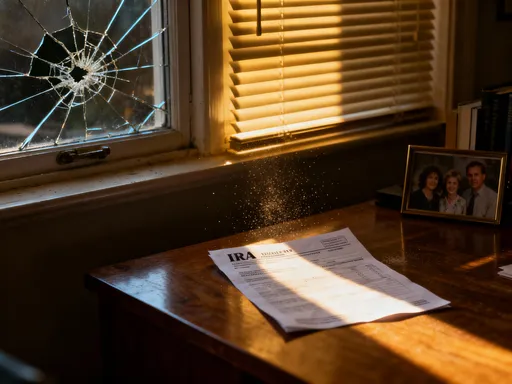

What makes market timing so difficult is not just the complexity of global markets, but the psychological pressure it places on individuals. When markets dip, fear takes over. Investors see falling values and react emotionally, often selling low out of concern for further losses. Conversely, when markets surge, optimism fuels overconfidence, leading many to buy high near peaks. This cycle of fear and greed creates a pattern of buying high and selling low—the exact opposite of sound investment strategy. The emotional burden of timing decisions can be overwhelming, especially for those without professional training or real-time data access.

Moreover, market movements are influenced by countless interrelated factors—economic data, geopolitical developments, central bank policies, corporate earnings, and investor sentiment—none of which follow predictable patterns. Even advanced algorithms used by hedge funds and institutional traders cannot guarantee accurate forecasts over time. For the average fund investor, attempting to time the market introduces unnecessary risk and often leads to underperformance compared to a disciplined, long-term approach. Instead of focusing on pinpoint accuracy in entry and exit points, a more effective strategy is to accept market uncertainty and build a plan that thrives within it.

The alternative to timing is consistency. By shifting focus from prediction to preparation, investors can develop a framework that emphasizes regular contributions, diversified exposure, and informed decision-making. This doesn’t mean ignoring market conditions altogether; rather, it means using market awareness as a tool for context, not control. The goal is not to outsmart the market, but to stay engaged with it in a rational, structured way. Over time, this mindset shift—from reactive timing to proactive understanding—can make the difference between average results and meaningful wealth accumulation.

Fund Dollar-Cost Averaging: Stability with Strategic Insight

Dollar-cost averaging (DCA) is widely recognized as a reliable method for reducing the risks associated with market volatility. At its core, DCA involves investing a fixed amount of money at regular intervals—monthly, quarterly, or bi-weekly—regardless of market conditions. This approach automatically buys more fund shares when prices are low and fewer when prices are high, smoothing out the average cost over time. While often promoted as a passive, hands-off strategy, DCA becomes even more powerful when paired with basic market analysis. When investors understand broader economic trends and valuation levels, they can apply DCA with greater intention, enhancing its effectiveness without sacrificing discipline.

For instance, during periods of market stress—such as sharp corrections or prolonged bear markets—valuation metrics like price-to-earnings ratios often fall below historical averages. An investor using DCA might choose to maintain or even increase their contribution rate during these times, knowing that each dollar buys more shares at discounted prices. This doesn’t require perfect foresight; it simply requires awareness. Similarly, in extended bull markets where valuations appear stretched, some investors may decide to rebalance or shift a portion of new contributions into more conservative funds, such as bond or balanced funds, to manage overall portfolio risk.

Another advantage of combining DCA with market insight is the ability to adapt to macroeconomic shifts. Consider rising interest rates—a development that typically pressures growth-oriented equity funds while benefiting certain types of bond or income funds. An investor monitoring these trends can adjust their DCA strategy by directing new contributions toward funds better suited to the current environment. This doesn’t mean abandoning DCA; it means applying it strategically across different asset classes based on evolving conditions. The key is maintaining regularity while allowing for thoughtful allocation shifts.

Real-world examples illustrate this hybrid approach. During the market turbulence of 2020, many long-term investors continued their DCA plans, taking advantage of depressed prices in sectors like travel and energy. Those who paused or withdrew funds missed the subsequent recovery, which began just months later. Conversely, investors who recognized the signs of economic reopening and gradually shifted new contributions toward cyclical sectors positioned themselves to benefit from the rebound. These decisions weren’t based on speculation, but on observation and preparation. By integrating market awareness into a disciplined DCA framework, investors can build resilience and improve long-term outcomes without succumbing to emotional impulses.

Reading the Market: What Fund Investors Should Actually Watch

For long-term fund investors, not all market data is equally useful. The financial media often highlights short-term fluctuations, technical indicators, or speculative narratives that can distract from what truly matters. Instead of trying to interpret every economic report or stock chart, investors should focus on a few key indicators that have demonstrated consistent relevance over time. These include interest rate trends, corporate earnings growth, inflation data, and broad measures of investor sentiment. Understanding these signals doesn’t require advanced expertise, but it does require clarity and focus.

Interest rates, set by central banks and reflected in bond yields, play a foundational role in shaping investment conditions. When rates rise, borrowing becomes more expensive, which can slow corporate expansion and reduce consumer spending. This often leads to lower earnings growth and can pressure equity fund values, especially in sectors like technology that rely on future earnings. Conversely, falling rates tend to stimulate economic activity and can support higher valuations. By monitoring rate trends, investors can anticipate shifts in market dynamics and adjust their fund allocations accordingly—perhaps favoring dividend-paying or value-oriented funds in higher-rate environments.

Earnings growth is another critical metric. While stock prices may fluctuate based on sentiment or speculation, long-term fund performance is ultimately tied to the profitability of the underlying companies. Sustained earnings growth supports higher valuations and dividend payments, both of which contribute to total returns. Investors should pay attention to quarterly earnings reports across major indices, as well as forward-looking earnings estimates. A consistent pattern of positive surprises or upward revisions can signal strength, while declining estimates may indicate emerging challenges. This doesn’t mean reacting to every earnings release, but rather assessing the broader trend over time.

Inflation is another key factor. Moderate inflation is normal in a growing economy, but rapid price increases erode purchasing power and can prompt central banks to tighten monetary policy. High inflation tends to hurt fixed-income investments and can create uncertainty in equity markets. However, certain fund categories—such as those focused on commodities, real estate, or inflation-protected securities—may perform better under these conditions. By tracking inflation reports and inflation expectations, investors can make more informed choices about asset allocation and risk exposure.

Finally, market sentiment—measured through surveys, volatility indices, and trading volume—provides insight into investor psychology. Extremely high optimism can signal overbought conditions, while widespread fear may indicate oversold opportunities. Sentiment should never be used in isolation, but when combined with other indicators, it can help investors avoid emotional extremes. The goal is not to predict the next market move, but to remain aware and prepared. By focusing on these core signals, fund investors can develop a practical, grounded understanding of market conditions without getting lost in noise.

Risk Control: Building Resilience into Your Investment Plan

No investment strategy is complete without a clear approach to risk management. Market downturns are not anomalies—they are inevitable features of long-term investing. The difference between successful and struggling investors often lies not in avoiding losses, but in how they prepare for and respond to them. For fund investors, risk control means building a portfolio that can withstand volatility without derailing long-term financial goals. This requires intentional diversification, thoughtful fund selection, and a personalized understanding of risk tolerance.

Diversification remains one of the most effective tools for managing risk. By spreading investments across different asset classes—such as equities, bonds, and alternative funds—investors reduce their exposure to any single source of loss. Within equity funds, further diversification across sectors, market capitalizations, and geographic regions adds another layer of protection. For example, a global equity fund that includes exposure to both developed and emerging markets can provide balance when regional economies perform differently. Similarly, combining growth-oriented funds with value or dividend-focused funds can smooth returns over market cycles.

Balanced or hybrid funds offer another avenue for risk control. These funds typically hold a mix of stocks and bonds, automatically adjusting exposure based on predefined rules or market conditions. They are particularly useful for investors seeking moderate growth with lower volatility. By investing in a balanced fund, individuals can achieve built-in diversification without needing to manage multiple accounts or rebalance frequently. However, it’s important to review the fund’s allocation strategy and expense ratio to ensure it aligns with personal objectives.

Another critical aspect of risk control is setting personal volatility thresholds. Every investor has a different capacity for risk, influenced by factors like time horizon, income stability, and financial responsibilities. A 40-year-old saving for retirement may tolerate more short-term fluctuation than a 60-year-old nearing withdrawal. By defining a comfort level with market swings—such as a maximum drawdown they are willing to accept—investors can make more rational decisions during turbulent periods. This might involve adjusting allocations gradually as goals approach, rather than making abrupt changes in response to market news.

Real-world scenarios highlight the value of proactive risk management. Consider an investor heavily concentrated in technology sector funds during the early 2000s or high-growth stocks in 2022. Without diversification or periodic rebalancing, their portfolios likely suffered significant losses during market corrections. In contrast, those who maintained balanced allocations and reviewed their strategies regularly were better positioned to recover. Risk control isn’t about eliminating uncertainty—it’s about ensuring that setbacks don’t compromise long-term progress.

When to Stick—and When to Shift: Making Smarter Fund Choices

Staying invested through market cycles is a cornerstone of long-term success, but persistence should not be confused with rigidity. There are times when a change in strategy is not only justified but necessary. The challenge lies in distinguishing between temporary setbacks and structural shifts that warrant action. For fund investors, this means developing a disciplined process for evaluating performance, understanding external changes, and making informed decisions—without falling into the trap of reactive trading.

One clear signal to reevaluate a fund is prolonged underperformance relative to its benchmark or peer group. Short-term lags can be normal, especially in volatile markets, but consistent underperformance over three to five years may indicate deeper issues—such as a change in investment style, poor management, or misalignment with market conditions. Before making any change, investors should examine the reasons behind the results. Was the fund impacted by a sector-wide downturn, or did it fail to adapt? Did the portfolio manager leave or change strategy? These factors matter more than raw returns alone.

Structural economic shifts also demand attention. For example, transitions in energy policy, demographic changes, or technological disruptions can alter the long-term outlook for certain industries. A fund heavily invested in fossil fuels may face challenges in a world moving toward renewable energy, while a fund focused on healthcare innovation might benefit from aging populations. These trends don’t require immediate action, but they do call for periodic review and, if necessary, reallocation. The goal is not to chase every new trend, but to ensure that investments remain aligned with the evolving economic landscape.

Changes in fund management can also be a red flag. A new portfolio manager may bring a different investment philosophy, risk appetite, or process. While not all changes are negative, they do introduce uncertainty. Investors should research the new manager’s track record and investment approach to determine whether the fund still fits their strategy. Similarly, significant changes in fees, minimum investments, or fund structure should prompt review. Higher expenses erode returns over time, and even small increases can have a meaningful impact on long-term growth.

The key to making smarter fund choices is having a clear decision-making framework. This includes setting criteria for evaluation—such as performance, risk, fees, and alignment with goals—and reviewing funds on a regular schedule, such as annually. When considering a change, investors should compare alternatives carefully, assess tax implications, and avoid emotional reactions to short-term results. The aim is thoughtful evolution, not impulsive overhaul. By combining patience with vigilance, investors can maintain stability while adapting to change.

The Psychology of Consistent Investing: Overcoming Emotional Traps

Even with solid knowledge and a well-structured plan, emotions can undermine investment success. Behavioral finance research has shown that psychological biases—such as loss aversion, recency bias, and overconfidence—routinely distort decision-making. Loss aversion, for example, causes people to feel the pain of a loss more intensely than the pleasure of an equivalent gain, leading many to sell during downturns to avoid further pain. Recency bias makes investors place too much weight on recent performance, causing them to buy high after a rally or sell low after a drop. These tendencies are natural, but they are also costly.

The first step in overcoming emotional traps is awareness. Recognizing that fear and greed are universal experiences—not personal failings—can help investors respond with discipline rather than reaction. One effective tool is creating pre-defined rules for investing behavior. For example, setting a rule to never sell during a market decline of less than 20% unless there’s a fundamental change in the investment thesis can prevent impulsive decisions. Similarly, establishing a fixed schedule for contributions and reviews removes emotion from routine decisions and reinforces consistency.

Regular review schedules are another safeguard. Instead of checking portfolio values daily or reacting to headlines, investors should commit to quarterly or annual reviews. This creates space between market noise and decision-making, allowing for more rational evaluation. During these reviews, they can assess performance, rebalance if needed, and confirm alignment with long-term goals. The process itself becomes a form of emotional regulation, turning reactive impulses into structured reflection.

Keeping an investment journal can also strengthen psychological resilience. By documenting decisions, the reasoning behind them, and emotional state at the time, investors gain insight into their own behavior over time. Looking back at past entries during turbulent markets can serve as a reminder of long-term principles and prevent repeating mistakes. Over time, this practice builds confidence and reinforces a disciplined mindset.

Ultimately, the most successful investors are not those with the best predictions, but those with the strongest habits. Discipline, supported by awareness and structure, is the true edge in long-term fund investing. By acknowledging emotional vulnerabilities and putting systems in place to manage them, investors can stay on course through market ups and downs.

Putting It All Together: A Smarter Path to Long-Term Growth

The journey to lasting wealth through fund investing is not about perfection. It’s about progress—consistent, informed, and resilient progress. By moving away from the futile pursuit of market timing and embracing a smarter, more analytical approach, investors can transform their relationship with the market. The foundation of this approach is dollar-cost averaging, not as a passive tactic, but as a strategic framework enhanced by market awareness. When combined with disciplined risk management, thoughtful fund selection, and emotional control, DCA becomes a powerful engine for long-term growth.

Success also comes from knowing what to watch and what to ignore. Rather than chasing every headline or technical signal, investors should focus on a few key indicators—interest rates, earnings, inflation, and sentiment—that provide meaningful context. These signals don’t offer predictions, but they do offer perspective. They help investors stay alert without overreacting, prepared without being paralyzed.

Risk control is not an afterthought—it is central to sustainability. Through diversification, balanced allocations, and personal risk thresholds, investors can build portfolios that endure market cycles. And when changes are needed, a structured decision-making process ensures that adjustments are thoughtful, not impulsive. This balance of stability and adaptability is what allows long-term goals to remain on track.

Finally, the psychological dimension of investing cannot be overlooked. Emotions will always be present, but they don’t have to be in charge. By establishing rules, maintaining regular review schedules, and reflecting on decisions, investors can cultivate the discipline that outlasts market noise. The goal is not to eliminate feeling, but to manage it with intention.

Putting it all together, the smarter path to long-term growth is not complicated, but it is deliberate. It requires patience, awareness, and consistency. It rewards those who focus not on getting everything right, but on staying committed to a sound process. In the end, market smarts don’t come from predicting the future—they come from understanding the present and acting with clarity. For the thoughtful fund investor, that’s where true advantage begins.