How I Built a Smarter Portfolio That Actually Protects My Gains

You’ve worked hard to grow your money—so why does it feel like one bad market move could undo everything? I’ve been there, chasing returns only to watch them vanish. That’s when I realized: real success isn’t just about growth, it’s about keeping what you earn. This is the shift that changed my approach to investing—focusing not just on gains, but on lasting financial safety. What I discovered wasn’t a magic formula or secret strategy, but a mindset grounded in discipline, structure, and realism. It’s about building a portfolio that doesn’t just climb during good times, but holds steady when markets turn. In this article, I’ll walk through the lessons I learned the hard way, the changes I made, and how you can design a portfolio that protects your progress without sacrificing long-term growth.

The Wake-Up Call: When Growth Wasn’t Enough

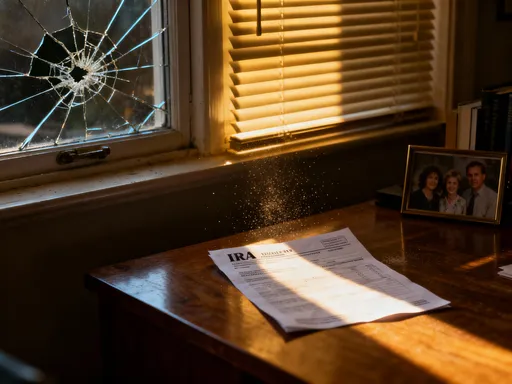

For years, my investment strategy was simple: find what was going up and get in fast. I followed the headlines, bought into trending sectors, and celebrated every quarterly gain. When my account balance jumped 15% in a single year, I felt like I had cracked the code. But that feeling didn’t last. A year later, a market correction erased nearly all of it. I wasn’t alone—many investors experienced the same rollercoaster—but the emotional toll was personal. Watching hard-earned gains disappear overnight made me question everything I thought I knew about investing.

The truth is, high returns without risk control are fragile. I had mistaken volatility for opportunity and momentum for sustainability. What I didn’t realize at the time was that unchecked exposure to equities, especially in narrow or speculative segments, can amplify losses just as quickly as gains. The turning point came when I reviewed my portfolio not just by performance, but by resilience. How much could it withstand a 20% market drop? Would I be forced to sell at a loss if I needed cash? These weren’t questions I had asked before, but they became essential.

That experience reshaped my entire philosophy. I began to see investing not as a race to the highest return, but as a long-term effort to preserve capital while allowing for growth. It wasn’t enough to make money—I needed to keep it. This shift didn’t happen overnight, but it started with a single realization: without protection, growth is temporary. From that moment, I committed to building a smarter, more balanced approach—one that prioritized sustainability over speed and stability over spectacle.

Rethinking Asset Allocation: More Than Just Diversification

Most investors hear “asset allocation” and think of dividing money between stocks, bonds, and cash. That’s a good start, but it’s only the surface. True asset allocation goes beyond categories—it’s about aligning investments with your personal financial situation, risk tolerance, and time horizon. I used to think I was diversified because I owned tech, healthcare, and consumer stocks. But when the market dropped, nearly all of them fell together. That’s when I learned the difference between superficial diversification and meaningful risk management.

Real diversification means including assets that don’t move in sync with each other—what finance professionals call non-correlated assets. For example, when stocks fall, high-quality bonds often hold steady or even rise in value. Real estate investment trusts (REITs) may behave differently than equities over time. Certain alternative investments, like managed futures or long-short strategies, can provide balance when traditional markets are stressed. I began to explore these options not for high returns, but for their ability to reduce overall portfolio volatility.

I also started thinking more strategically about rebalancing. Without it, a portfolio can drift far from its original risk profile. If stocks surge, they can grow from 60% of a portfolio to 75%—increasing exposure without any new decisions. I set clear thresholds—like rebalancing when any asset class moves more than 5% from its target—and scheduled regular reviews. This simple discipline kept my risk level consistent, even when emotions might have led me astray.

Another key insight was the importance of intentional exposure. Instead of spreading money evenly across categories, I began to assign roles to each asset. Some were for growth, others for income, and others for stability. This functional approach helped me make more purposeful decisions and avoid the trap of chasing performance. Asset allocation, I realized, isn’t just a technical exercise—it’s a framework for long-term financial clarity.

The Role of Defensive Assets: Your Portfolio’s Safety Net

During market rallies, defensive assets don’t get much attention. They don’t make headlines or deliver explosive returns. But when markets turn, they become invaluable. I used to overlook them, chasing higher yields and faster growth. But after experiencing sharp drawdowns, I began to appreciate the quiet strength of assets designed to preserve capital. These include short-duration bonds, high-quality corporate debt, dividend-paying stocks with strong balance sheets, and certain alternative strategies that aim to reduce volatility.

Defensive assets act as shock absorbers. When equities decline, these holdings tend to be less volatile, helping to cushion the overall impact on the portfolio. For example, short-duration bonds are less sensitive to interest rate changes than long-term bonds, making them more stable in rising rate environments. Similarly, dividend-paying stocks from established companies—especially in sectors like utilities, consumer staples, and healthcare—often continue to generate income even when prices fluctuate.

One of the most important benefits of defensive assets is psychological. Knowing that part of my portfolio is designed to hold steady gives me confidence to stay the course during downturns. Instead of panicking and selling at a loss, I can rely on the stability of these holdings to maintain balance. This doesn’t mean abandoning growth—it means creating a foundation that allows me to take measured risks without jeopardizing my financial security.

I also learned that defensive doesn’t mean low return. Over time, consistent performance with lower volatility can lead to better compounded results, especially when it prevents large losses that are hard to recover from. A 20% loss requires a 25% gain just to break even. By reducing the depth of drawdowns, defensive assets improve the efficiency of long-term growth. They may not be exciting, but they are essential for sustainable wealth building.

Dynamic Rebalancing: Staying on Track Without Emotional Decisions

One of the biggest challenges in investing is removing emotion from decision-making. I used to react to market movements—buying more when prices rose and selling when they fell. This instinct is common, but it’s also one of the most destructive habits in personal finance. What I needed wasn’t more information, but a system that removed the need to make impulsive choices. That’s where dynamic rebalancing came in.

Rebalancing is the process of bringing your portfolio back to its target allocation after market movements shift the balance. For example, if stocks outperform and grow from 60% to 70% of your portfolio, you sell some stocks and buy bonds to restore the original mix. This forces you to “buy low and sell high” in a disciplined way, without trying to time the market. I set clear rules: I would review my portfolio every six months and rebalance if any asset class deviated by more than 5% from its target.

This approach has several advantages. First, it maintains a consistent risk level. Without rebalancing, your portfolio can become increasingly aggressive over time, simply because one asset class has performed well. Second, it prevents emotional decisions. Instead of reacting to fear or greed, I follow a predefined plan. Third, it creates a rhythm of regular review, which helps me stay engaged with my finances without overtrading.

I also automated parts of the process. I use alerts to notify me when thresholds are approached and schedule review dates on my calendar. Some brokerage platforms offer automatic rebalancing tools, which I use for certain accounts. The goal isn’t perfection—it’s consistency. By sticking to a rules-based system, I’ve avoided the temptation to chase performance or flee during downturns. Rebalancing has become my anchor, keeping me focused on the long term.

Income Streams as Protection: Turning Investments into Cash Flow

One of the most powerful shifts in my investing journey was realizing that income can be a form of protection. Early on, I focused almost entirely on capital appreciation—how much my portfolio could grow in value. But I overlooked the importance of cash flow. Then I faced a period when I needed to withdraw money from my portfolio during a market downturn. Selling assets at a loss felt like defeat. That experience taught me a critical lesson: if your investments generate regular income, you don’t have to sell when prices are low.

I began to restructure part of my portfolio to emphasize yield-producing assets. This included carefully selected dividend-paying stocks from companies with a history of stable payouts, REITs that distribute rental income, and structured notes that offer defined return profiles. I didn’t chase the highest yields—many high-dividend stocks carry higher risk—but focused on quality and sustainability. The goal was predictable, reliable income, not speculation.

This shift had multiple benefits. First, it reduced my reliance on market timing. Even in flat or declining markets, I could cover expenses with dividends and interest, preserving my principal. Second, it improved my peace of mind. Knowing I had a steady stream of income made market fluctuations less stressful. Third, it enhanced compounding. By reinvesting dividends during downturns, I could buy more shares at lower prices, boosting long-term growth.

Income also provides flexibility. If I want to make a large purchase or help family members, I can use investment earnings instead of tapping into savings or retirement accounts. This approach doesn’t eliminate risk, but it adds a layer of resilience. A portfolio that generates income is not just a store of value—it’s a working asset that supports your life today while growing for tomorrow.

Risk Layering: Building a Portfolio That Adapts

As my understanding of investing deepened, I moved from a simple allocation model to a more sophisticated structure: risk layering. Instead of treating my portfolio as a single bucket, I began to think in tiers, each with a specific purpose. This approach allows me to balance stability and opportunity in a way that adapts to changing conditions without sacrificing my core principles.

The first layer is my core holdings—broad-market index funds, high-quality bonds, and dividend-paying stocks. This foundation makes up the majority of my portfolio and is designed for long-term growth and stability. It’s not flashy, but it’s reliable. The second layer consists of satellite positions—targeted investments in specific sectors, countries, or themes that offer higher growth potential. These are smaller in size and carefully monitored. The third layer is tactical allocations—short-term opportunities or hedges that I can adjust as market conditions change.

This tiered approach gives me flexibility. If I see a compelling opportunity, I can allocate to the tactical layer without disrupting my core strategy. If markets become volatile, I can reduce exposure in the satellite or tactical layers while keeping my foundation intact. It’s like having a home with a strong foundation, flexible rooms, and movable furniture—secure, functional, and adaptable.

Risk layering also helps me manage emotions. Because I know my core is protected, I can take measured risks in other areas without fear of catastrophic loss. It’s not about avoiding risk altogether—it’s about managing it intelligently. This structure has made me a more confident investor, one who can respond to change without abandoning discipline.

The Long Game: Why Patience and Process Beat Short-Term Wins

After years of learning, adjusting, and sometimes stumbling, I’ve come to a simple but profound conclusion: lasting financial success isn’t about big wins—it’s about consistent, thoughtful decisions. I used to measure my progress by quarterly returns, chasing the next hot stock or trend. Now, I measure it by resilience, discipline, and peace of mind. The real victory isn’t in making the most money in a single year, but in building a portfolio that endures over decades.

What changed wasn’t just my strategy, but my mindset. I no longer see the market as something to beat, but as a tool to serve my long-term goals. I focus on process over performance, planning over prediction, and patience over panic. I accept that I can’t control market movements, but I can control my behavior, my allocations, and my responses.

This approach hasn’t made me rich overnight, but it has made me financially secure. I sleep better knowing my portfolio is designed to protect as well as grow. I’m no longer afraid of downturns—they’re part of the journey, not a disaster. And I’ve learned that real wealth isn’t just what you accumulate, but what you keep.

If there’s one lesson I hope you take from my experience, it’s this: investing is not a sprint. It’s a marathon that rewards discipline, structure, and emotional control. By focusing on protection as much as growth, you build not just a portfolio, but a legacy of financial stability. That’s the kind of success that lasts.