Shining Assets: Why Jewelry Belongs in Your Investment Portfolio

You’ve diversified with stocks, bonds, and maybe even real estate—so why not consider what’s been holding value for centuries? Jewelry isn’t just heirloom glamour; it’s a tangible, portable, and timeless asset. I’ve tested this corner of alternative investing, and it’s more strategic than sentimental. Let’s unpack how gemstones and precious metals can stabilize returns, hedge against inflation, and add resilience to your portfolio—without promising unrealistic gains. Unlike digital entries on a screen or paper certificates, jewelry offers physical presence, cultural endurance, and enduring demand. It doesn’t vanish in a market crash or system failure. When currencies waver and equities tumble, gold still gleams, diamonds still draw admiration, and craftsmanship still commands respect. This isn’t about chasing trends or flaunting wealth—it’s about making thoughtful, informed choices that anchor your financial future in something real.

The Hidden Strength of Tangible Assets

In an era dominated by digital transactions and intangible assets, the appeal of something you can hold, see, and touch has never been stronger. Tangible assets like real estate, fine art, and yes—jewelry—offer a psychological and financial anchor in uncertain times. They are not subject to the same volatility as stock prices, which can swing wildly based on investor sentiment, algorithmic trading, or geopolitical headlines. Jewelry, particularly pieces made from precious metals and high-quality gemstones, carries intrinsic value rooted in scarcity, durability, and universal recognition. Gold, for instance, has maintained purchasing power across centuries, serving as currency, ornament, and store of wealth in civilizations from ancient Egypt to modern central banks.

What makes jewelry uniquely resilient is its dual nature: it is both a luxury item and a hard asset. During periods of high inflation or economic instability, investors often turn to gold and other precious materials as a hedge. Central banks continue to hold gold reserves not because it sparkles, but because it holds value when paper money weakens. Similarly, rare gemstones like Burmese rubies, Kashmir sapphires, or pink diamonds have demonstrated consistent appreciation over decades, independent of stock market performance. This independence is crucial. When traditional portfolios suffer losses, tangible assets can help preserve capital and reduce overall portfolio risk.

Historical data supports this pattern. In the aftermath of the 2008 financial crisis, while global stock markets plummeted, demand for gold surged, pushing prices to record highs. Auction houses like Sotheby’s and Christie’s reported strong sales in high-end jewelry, with collectors and investors alike seeking refuge in rare pieces. Even during the economic uncertainty of the early 2020s, fine jewelry maintained steady demand, particularly for certified diamonds and vintage designs. These patterns suggest that jewelry is not merely decorative—it is a financial instrument with a long track record of stability. Its value does not depend on quarterly earnings reports or interest rate forecasts. Instead, it relies on physical properties, craftsmanship, and enduring human desire for beauty and rarity.

How Jewelry Fits Into a Balanced Investment Portfolio

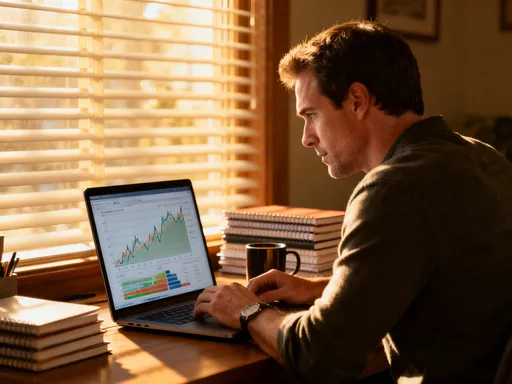

Diversification remains one of the most effective strategies for managing investment risk. The principle is simple: don’t put all your eggs in one basket. Most investors understand the importance of spreading capital across different asset classes—stocks, bonds, real estate, and cash. Yet few consider alternative investments like jewelry, despite its proven ability to perform differently than traditional markets. This lack of correlation is precisely what makes jewelry a valuable addition to a balanced portfolio. When equities decline, jewelry values often remain stable or even rise, offering a buffer against losses.

Seasoned investors have long included alternative assets in their wealth preservation strategies. Many financial advisors recommend allocating 5% to 10% of a portfolio to non-traditional holdings such as fine art, collectibles, or precious metals. Within this category, jewelry stands out due to its portability, liquidity (relative to other collectibles), and global recognition. A well-chosen piece of jewelry can be stored securely, transported easily, and verified through standardized grading systems—a level of clarity not always present in other alternative investments like vintage cars or rare wines.

Consider the example of an investor who, in 2005, allocated a portion of their portfolio to a high-quality diamond ring certified by the Gemological Institute of America (GIA). Over the next 15 years, while stock markets experienced two major downturns, the value of that diamond likely appreciated steadily, driven by increasing demand and limited supply. Meanwhile, the emotional satisfaction of owning a beautiful object adds another dimension—this is not just an investment, but one that brings daily pleasure. The key, however, is intentionality. Buying jewelry purely for sentimental reasons—such as an engagement ring or gift—may not yield the same financial benefits. Investment-grade pieces should be selected based on objective criteria: material quality, certification, rarity, and market demand.

What Makes Jewelry a Store of Value?

Not all jewelry appreciates in value. In fact, most mass-produced pieces from mainstream retailers do not retain their original price, let alone increase in worth. The difference lies in quality, authenticity, and provenance. To function as a store of value, jewelry must meet specific standards. First and foremost is the purity of the metal. Gold, for example, is measured in karats, with 24-karat representing pure gold. However, 18-karat gold (75% pure) is often preferred in fine jewelry for its balance of durability and value. Platinum, though more expensive, is denser and rarer than gold, making it a strong candidate for long-term holding.

When it comes to gemstones, the “Four Cs”—carat, cut, color, and clarity—are essential metrics. A diamond’s value increases significantly with higher grades in each category. But beyond these basics, rarity plays a decisive role. Colorless diamonds are valuable, but rare colored diamonds—such as pink, blue, or green—can command exponentially higher prices due to their scarcity. A 5-carat pink diamond, for instance, may be worth millions, while a similarly sized white diamond might fetch a fraction of that amount. The same principle applies to colored gemstones: Burmese rubies, Colombian emeralds, and Kashmir sapphires are consistently sought after for their superior color and limited availability.

Equally important is certification. Reputable grading institutions like the GIA, American Gem Society (AGS), or Swiss Gemmological Institute (SSEF) provide objective assessments of a stone’s quality. These reports serve as a piece’s financial passport, enabling resale and verification across borders. Without proper documentation, even a stunning piece may struggle to find buyers at fair market value. Provenance—such as a piece originating from a famous designer like Cartier or Van Cleef & Arpels, or with a documented history—can further enhance desirability and value. Vintage and antique jewelry, particularly from eras like Art Deco or Edwardian, often appreciate faster than modern counterparts due to craftsmanship and historical significance.

Risks and How to Manage Them

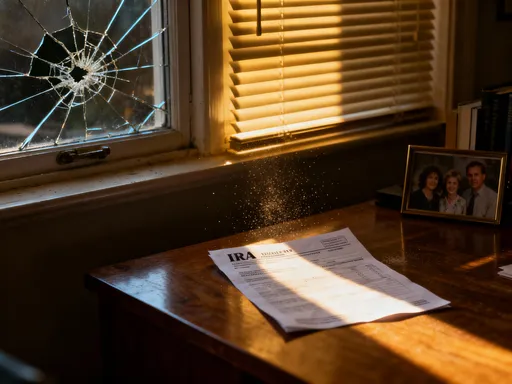

Like any investment, jewelry carries risks that must be understood and managed. The most commonly cited concern is liquidity. Unlike stocks, which can be sold instantly through a brokerage, jewelry requires time and effort to sell at fair value. Finding a reputable buyer, especially for high-value pieces, may take weeks or months. Selling quickly—such as through pawn shops or online marketplaces—often results in significant discounts, sometimes as much as 30% to 50% below market value. This illiquidity means jewelry should be viewed as a long-term holding, not a short-term trading vehicle.

Authenticity is another critical issue. The market includes replicas, synthetic stones, and misgraded items, particularly in online auctions or unverified sellers. A diamond that appears flawless to the naked eye may have inclusions revealed under magnification, drastically affecting its worth. To mitigate this risk, investors should always purchase from trusted dealers and insist on third-party certification. Reputable auction houses and established jewelers typically provide guarantees of authenticity, reducing the chance of fraud.

Storage and insurance are additional considerations. Jewelry must be kept in a secure location, such as a bank safety deposit box or a home safe, to prevent loss or theft. Insurance is essential, but standard homeowner’s policies often provide inadequate coverage. A separate rider or specialized jewelry insurance policy ensures full replacement value in case of damage or disappearance. Finally, emotional attachment can cloud judgment. It’s easy to overvalue a piece because of its sentimental meaning, leading to poor financial decisions. Successful jewelry investors maintain discipline, treating their purchases as financial assets first and sentimental objects second. By acknowledging these risks and taking proactive steps, investors can protect their capital and make informed choices.

Practical Steps to Start Your Jewelry Investment Journey

Entering the world of jewelry investing doesn’t require a fortune, but it does require knowledge and caution. The first step is education. Understanding the basics of gemology, metal purity, and market trends empowers buyers to make confident decisions. Resources such as the GIA website, industry publications, and museum exhibitions offer valuable insights. Once informed, investors can begin exploring purchase channels. Auction houses like Sotheby’s, Christie’s, and Bonhams are excellent sources for rare and high-value pieces, often accompanied by detailed provenance and certification. While bidding can be competitive, these venues offer transparency and expert curation.

Specialized jewelers and dealers are another option, particularly for those seeking certified diamonds or vintage pieces. Reputable dealers will provide full documentation, allow independent appraisal, and stand behind their products. Estate sales and private collections can also yield hidden gems—literally—where undervalued items may be overlooked by non-experts. However, due diligence is paramount. Buyers should always request a recent appraisal from a certified gemologist and verify the piece’s history when possible. Online platforms can be convenient, but they carry higher risks of fraud or misrepresentation, making them less ideal for beginners.

Budgeting wisely is essential. Rather than buying multiple low-quality items, investors are better served by purchasing one high-quality piece that meets investment criteria. Timing is less important than selection—jewelry is not a market to time like stocks. Instead, focus on acquiring the best quality within your means. Patience is a virtue: true appreciation often takes a decade or more. Building relationships with trusted dealers, attending auctions, and staying informed about market trends will improve decision-making over time. Starting small, learning continuously, and prioritizing quality over quantity are the hallmarks of a successful jewelry investor.

Real Returns: What to Expect (and What Not to)

It’s important to set realistic expectations. Jewelry is not a get-rich-quick scheme. While headlines occasionally spotlight a rare diamond selling for tens of millions, these are exceptions, not the norm. Most investment-grade jewelry appreciates modestly over time, typically in line with or slightly above inflation. A well-chosen piece may double in value over 20 to 30 years, offering steady wealth preservation rather than explosive growth. This slow but reliable appreciation is precisely what makes it valuable in a portfolio—it stabilizes rather than speculates.

Data from auction results supports this view. According to reports from major auction houses, high-quality colored diamonds have seen average annual returns of 6% to 8% over the past two decades, outperforming many traditional asset classes during periods of market stress. Vintage and designer pieces from the early 20th century have also shown strong performance, with some Art Deco jewelry increasing in value by over 150% in 15 years. These gains are not guaranteed, but they reflect the power of scarcity, craftsmanship, and enduring demand.

Compared to speculative assets like cryptocurrencies or meme stocks, jewelry offers a fundamentally different proposition. It does not promise overnight riches, but it does provide a hedge against systemic financial risks. In times of currency devaluation or economic uncertainty, its physical nature becomes an advantage. Unlike digital assets that rely on technology and trust in platforms, jewelry exists independently. It requires no internet connection, no password, and no third-party validation to hold worth. Its value is recognized across cultures and borders, making it a truly global asset. Investors should view jewelry not as a primary source of returns, but as a stabilizing force—a quiet guardian of wealth that works in the background, preserving value while other assets fluctuate.

Building a Legacy, Not Just a Portfolio

Perhaps the most profound benefit of jewelry as an investment is its ability to transcend finance and become part of a family’s story. Unlike stocks or bonds, which exist as entries in an account, jewelry is tangible, personal, and meaningful. A diamond pendant passed from mother to daughter carries not just monetary value, but memories, love, and continuity. This emotional dimension enhances its worth, making it more than just an asset—it becomes a legacy.

Strategic selection today can ensure that future generations inherit both financial security and cherished heirlooms. Imagine a granddaughter unwrapping a vintage brooch from the 1920s, learning its history, and wearing it with pride. The piece may have appreciated in value, but its true significance lies in its journey through time. This dual benefit—financial and emotional—is rare in the world of investing. It allows families to preserve wealth in a form that is both beautiful and enduring.

Jewelry also offers flexibility in estate planning. Because it is portable and divisible, it can be distributed among heirs without the complexities of real estate or business ownership. Each piece can be matched to a recipient based on personal connection, ensuring that the inheritance feels thoughtful and personal. At the same time, its market value provides a clear financial baseline, reducing disputes over valuation. In this way, jewelry serves as both a practical tool and a symbolic gesture—a bridge between generations.

In conclusion, jewelry deserves a place in a thoughtful, well-rounded investment strategy. It is not a replacement for stocks or bonds, but a complementary asset that adds resilience, diversification, and timeless value. Grounded in scarcity, beauty, and durability, it offers protection against inflation, emotional satisfaction, and the potential for long-term appreciation. For the informed investor—especially those seeking stability, legacy, and tangible security—jewelry is not just adornment. It is a quiet, enduring form of wealth that stands the test of time.