From Passion to Profit: How I Turned My Hobby Into a Smarter Investment Mindset

What if your weekend hobby could do more than just clear your mind—what if it could reshape how you think about money? I didn’t realize it at first, but diving deep into my personal interests quietly transformed my entire approach to spending and saving. It wasn’t about making money from the hobby itself, but about how pursuing joy led to smarter financial habits. This is the story of how rising personal tastes met real-world finance, and why passion projects might be the missing piece in your wealth journey. What began as simple leisure evolved into a powerful lens for evaluating value, managing risk, and building long-term financial resilience. The shift wasn’t dramatic—it was subtle, consistent, and deeply personal. Yet its impact on my financial decisions has been profound.

The Wake-Up Call: When Spending on Fun Felt Empty

For years, I treated my hobbies as emotional sanctuaries—spaces where rules didn’t apply and budgets didn’t matter. Whether it was upgrading my photography equipment, attending niche craft fairs, or buying specialty materials, I justified every purchase as self-care. After all, wasn’t it healthy to invest in joy? But over time, a quiet unease settled in. The excitement of a new tool or event wore off faster. What remained wasn’t fulfillment, but clutter: shelves full of unused supplies, drawers with half-finished projects, and bank statements that told a story of consistent outflow with little lasting return. I began to question the real cost of my leisure. Was this spending enriching my life—or just masking stress?

This disconnect between emotional satisfaction and financial reality was my first warning sign. Behavioral economists call this the ‘hedonic adaptation’ effect—the tendency for pleasure from new purchases to fade quickly, prompting the need for more. I was caught in a cycle: buy, enjoy briefly, feel empty, repeat. The deeper issue wasn’t the hobby itself, but the unconscious way I engaged with it. I had separated ‘fun spending’ from ‘serious money decisions,’ treating one as guilt-free and the other as restrictive. But money doesn’t recognize that boundary. Every dollar spent in the name of passion is a dollar not saved, invested, or used elsewhere. Recognizing this was uncomfortable, but necessary. It forced me to ask a fundamental question: Can a hobby bring both joy and financial wisdom? The answer, I discovered, wasn’t in spending less—but in spending better.

Redefining Value: From Consumption to Investment in Self

The turning point came when I shifted my mindset: What if I stopped seeing my hobby spending as mere consumption and started viewing it as an investment in myself? This wasn’t about expecting a direct financial return—like selling handmade goods for profit—but about recognizing that time and money spent on meaningful activities build skills, confidence, and long-term well-being. This reframe changed how I evaluated every purchase. Instead of asking, “Do I want this?” I began asking, “Will this deepen my ability? Will it enhance my experience over time? Could it reduce future costs?” Suddenly, the decision to buy a high-quality camera lens wasn’t about status—it was about durability, learning, and the ability to create better work without constant upgrades.

This mindset shift aligns with a principle often seen in financial planning: the difference between assets and liabilities. An asset is something that retains or increases in value, while a liability loses value over time. Applied to hobbies, a well-chosen tool, a skill-building course, or even a membership in a supportive community can function like an asset. They provide lasting utility and open doors to growth. On the other hand, trendy accessories, limited-edition collectibles, or gadgets used only once are more like liabilities—they drain resources without delivering sustained benefit. By treating my hobby budget as a personal development fund, I became more intentional. I started prioritizing purchases that offered compound value: things that improved my skill, saved time, or reduced future spending. This wasn’t austerity—it was alignment.

Tracking the Hidden Costs—and Gains—of Passion

To gain clarity, I began tracking not just what I spent on my hobby, but how I spent my time and energy. I created a simple spreadsheet with columns for cost, time invested, emotional satisfaction, and long-term usefulness. At first, the data was revealing. A $200 workshop I attended on advanced techniques scored high on all measures: it improved my skills, inspired new projects, and paid for itself by helping me avoid costly mistakes. In contrast, a series of small impulse buys—specialty paints, decorative tools, themed event tickets—added up to nearly $500 over six months, yet delivered little lasting value. Most had been used once or sat untouched.

What surprised me most was the concept of opportunity cost—the value of what I gave up by spending that money elsewhere. Those $500 in small purchases could have funded a high-impact course, contributed to an emergency fund, or been invested. Tracking made the invisible visible. It also helped me identify high-leverage investments: purchases that had ripple effects. For example, buying a durable storage system reduced clutter, saved time, and protected my materials—effectively lowering my long-term hobby costs. Similarly, investing in a repair guide helped me fix broken tools instead of replacing them. These weren’t flashy buys, but they delivered steady returns. The key wasn’t eliminating spending—it was redirecting it toward choices that supported both joy and financial health. Over time, this practice fostered greater awareness, not restriction. I didn’t stop buying things I loved—I just became more selective, ensuring each purchase earned its place in my life and budget.

Risk Control: Avoiding the Trap of Emotional Overinvestment

Passion can be a double-edged sword. It fuels dedication, but it can also cloud judgment. I learned this the hard way when I nearly committed to a premium membership in a niche online community. The pitch was compelling: exclusive content, early access to events, and recognition among peers. The price? $300 per year—more than I’d ever spent on a single hobby-related fee. What made it dangerous wasn’t the cost alone, but the emotional pull. I wanted to belong, to be seen as serious and committed. The fear of missing out—FOMO—was strong. It took stepping back and asking objective questions to see clearly: What specific benefits would I actually use? Were there free or lower-cost alternatives? Would this enhance my skills, or just my status?

This experience taught me that emotional attachment increases financial risk. In hobby circles, scarcity, exclusivity, and social validation are often used to drive spending. Limited-edition items, invitation-only events, and ‘expert’ certifications can feel essential, but many offer little real utility. The danger lies in conflating identity with ownership—believing that buying certain items makes you a better artist, gardener, or photographer. To protect against this, I developed a few safeguards. First, I adopted the 48-hour rule: for any purchase over $100, I waited two days before deciding. This simple pause allowed emotions to settle and logic to return. Second, I sought third-party validation—talking to someone uninvolved in the hobby to get an outside perspective. Finally, I asked myself: If I couldn’t tell anyone I owned this, would I still want it? If the answer was no, it was likely a status play, not a value play. These strategies didn’t eliminate desire, but they restored balance, helping me avoid costly regrets.

The Compound Effect of Smart Hobby Spending

As I applied these principles, something unexpected happened: my improved spending habits began to spill over into other areas of my financial life. The discipline I practiced in my hobby budget—tracking, delaying gratification, prioritizing value—started influencing how I approached groceries, home repairs, and even retirement planning. This is what behavioral scientists call ‘habit stacking’: improving one behavior strengthens related ones. By mastering small financial decisions in a low-stakes area like a hobby, I built confidence and competence that transferred to bigger decisions. I became more comfortable saying no, more skilled at researching options, and more aware of emotional triggers.

The compound effect became clear over time. Every dollar I redirected from impulse buys into high-value investments—whether a course, a durable tool, or a financial contribution—earned returns in multiple ways. The tool saved money on replacements. The course improved my work, leading to small income opportunities. The savings grew through interest. More importantly, the mindset shift was cumulative. Each intentional choice reinforced a sense of control and purpose. I wasn’t just saving money—I was building a financial identity rooted in awareness and intention. This didn’t happen overnight. It required consistency, reflection, and occasional course correction. But the longer I practiced, the more natural it became. What started as a hobby audit evolved into a broader philosophy of mindful spending—one that valued both enjoyment and sustainability.

Turning Passion into Practical Financial Gains

One of the most surprising outcomes was the emergence of indirect income streams. I never set out to monetize my hobby, but as my skills deepened and my network grew, opportunities appeared. I started by selling unused materials and gear—items I’d bought impulsively but never used. That brought in a few hundred dollars, which I reinvested into higher-value tools. Then, a local community center asked if I’d teach a beginner’s workshop. I hesitated at first—was I qualified? But with my experience and organized knowledge, I created a simple curriculum and delivered a well-received class. The pay wasn’t huge, but it covered my annual hobby expenses for that year.

Over time, I was invited to consult on small projects, write guest articles for hobby newsletters, and even partner with a local supplier to demo products. None of this was aggressive marketing—it was the natural result of being engaged, knowledgeable, and consistent. The key was that I never let earning overshadow enjoyment. I said no to opportunities that felt pressured or exploitative. I protected the joy at the core of my hobby, ensuring that any income it generated was a bonus, not a burden. This approach aligns with a sustainable model of passion-based income: not turning your hobby into a job, but allowing it to open doors on its own terms. When financial awareness guides your engagement, the line between spending and earning blurs in the best possible way—creating a cycle where joy fuels growth, and growth supports joy.

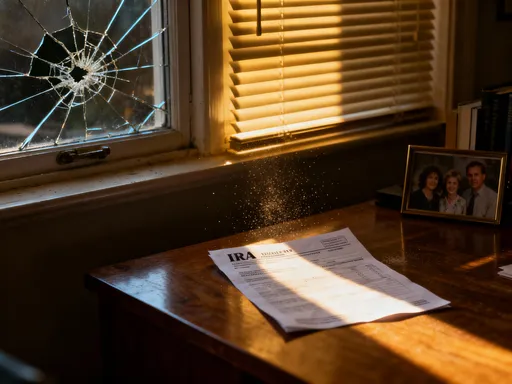

A New Definition of Wealth: Beyond Net Worth

Looking back, the greatest return on my hobby hasn’t been financial—it’s been transformational. I now measure wealth not just by my savings account or investment portfolio, but by how well my spending reflects my values. True financial health isn’t about deprivation or relentless accumulation. It’s about alignment: spending that supports well-being, growth, and purpose. My hobby, once a source of quiet guilt, has become a training ground for smarter financial behavior. It taught me to distinguish between cost and value, to manage emotional impulses, and to invest in things that compound over time—whether skills, relationships, or peace of mind.

This journey mirrors a broader shift in how we think about personal finance. It’s no longer just about numbers on a spreadsheet. It’s about behavior, mindset, and the quality of our daily choices. When guided by intention, even消费升级—rising personal tastes—can become a force for financial clarity. Passion projects don’t have to drain resources; they can strengthen them. They remind us that money is a tool, not a master. It should serve our lives, not dictate them. By bringing awareness to how we spend in the areas we love most, we build not just wealth, but wisdom. And in the end, that’s the most valuable return anyone can earn.