Unlocking Retirement Learning Without Emptying Your Wallet

So you're thinking about learning new things in retirement—but worried about the cost? I was too. Turns out, funding your curiosity doesn’t mean draining savings. I’ve tested smart ways to manage money while diving into courses, workshops, and hobbies. It’s not about cutting back—it’s about planning forward. Let me walk you through how to make lifelong learning affordable, sustainable, and genuinely rewarding—without financial stress. The truth is, many retirees assume that education ends with their careers. But mental engagement is just as essential in later life as financial security. And while staying curious is enriching, it can come with real costs. The good news? With thoughtful planning and disciplined habits, you can continue growing intellectually without compromising your financial well-being.

Why Retirement Learning Costs More Than You Think (And How to Prepare)

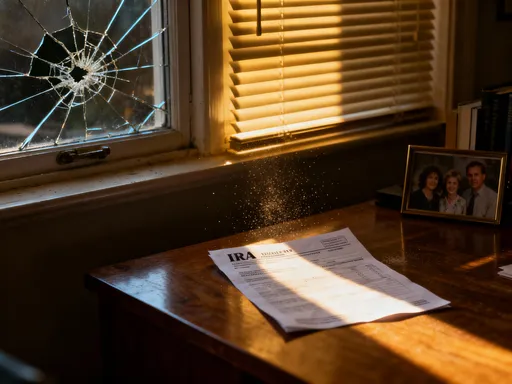

Many retirees envision a future filled with enriching experiences—art classes, language courses, travel-based workshops, or even earning a certificate in a new field. What they often fail to account for is the cumulative financial impact of these pursuits. The registration fee for a single course might seem manageable at $150, but when paired with the cost of materials, software subscriptions, transportation, or upgraded internet service, expenses can rise quickly. A retiree taking two online courses a year, attending one local workshop, and purchasing necessary tools could easily spend over $1,000 annually—money that, if unplanned, may come from essential living funds.

This hidden cost of lifelong learning stems from viewing education as an occasional indulgence rather than a planned component of retirement life. Unlike work-related training, which was often subsidized, post-career learning typically falls entirely on the individual. Additionally, retirees may not anticipate technology-related expenses. For example, accessing online platforms may require a reliable device, updated operating systems, or even technical support services—costs that are frequently overlooked. Some programs also require specific software, such as photo editing tools for a digital photography class or music production apps for a composition course, adding another layer of spending.

Preparation begins with awareness. Recognizing that learning has both direct and indirect costs allows retirees to plan proactively. Instead of reacting to fees as they arise, the goal is to integrate educational spending into the broader retirement budget. This shift in mindset—from reactive to strategic—protects long-term financial stability. It also ensures that the pursuit of knowledge enhances quality of life rather than creating stress. By treating learning as a priority, not a luxury, retirees gain greater control over their time, money, and personal growth.

Building a Learning-Focused Retirement Budget: What Actually Works

Creating a budget that supports lifelong learning doesn’t require complex financial models or drastic lifestyle changes. What it does require is clarity, consistency, and a willingness to treat education as a meaningful category—not an afterthought. Start by defining your learning goals for the year. Are you interested in mastering a language? Exploring history through online lectures? Taking up painting or woodworking? Each goal carries different cost implications, so specificity helps in forecasting expenses accurately.

Once goals are identified, estimate associated costs. Include not only course fees but also materials, software, transportation, and any potential technology upgrades. For instance, a $99 online course may require a $50 textbook and a $10 monthly subscription to a learning app. These add-ons can double or even triple the initial price. To manage this, set a realistic annual learning budget—perhaps $500 to $1,500, depending on your overall financial picture. This amount should be drawn from discretionary income, not from funds earmarked for housing, healthcare, or groceries.

Next, consider opening a dedicated savings account for educational expenses. Automating monthly transfers—even as little as $40—builds a cushion over time. This method transforms large, intimidating payments into manageable increments. For example, saving $50 per month accumulates to $600 in a year, enough to cover several high-quality courses or a local workshop. The psychological benefit is just as valuable: knowing funds are set aside reduces anxiety and increases confidence in pursuing new interests.

Flexibility is key. A rigid budget may discourage exploration, while one that adapts to changing interests supports sustained engagement. Review your learning budget quarterly. Did you overspend in one area but save in another? Did a free community program replace a paid course? Adjust accordingly. The goal isn’t perfection—it’s sustainability. When learning is integrated into your financial plan, it becomes a stable, enriching part of retirement rather than a source of guilt or regret.

Smart Funding Strategies: Stretching Every Dollar in Later Life

Financial wisdom in retirement isn’t about spending less—it’s about getting more value from every dollar. The good news is that numerous low-cost or no-cost learning opportunities exist, often within reach but underutilized. Community colleges, for example, frequently offer non-credit enrichment courses at a fraction of university prices. Topics range from creative writing and world history to computer basics and nutrition. Many of these programs welcome retirees with discounted or waived fees, especially for audit-only participation.

Public libraries remain one of the most powerful yet overlooked resources. Beyond physical books, most libraries provide free access to online learning platforms such as LinkedIn Learning, Gale Courses, or Universal Class. These platforms host thousands of courses in subjects like photography, personal finance, foreign languages, and home repair—all available with a library card. Some libraries even lend out technology, including tablets and Wi-Fi hotspots, removing barriers for those without reliable internet access at home.

Alumni benefits are another underused advantage. If you hold a degree from a college or university, check what lifelong learning perks are available. Many institutions offer free or discounted access to online courses, webinars, or campus lectures for alumni. Some even provide reduced tuition for retirees enrolling in credit-bearing classes. These benefits are part of your educational legacy—use them.

Intergenerational learning programs also offer cost-effective and socially enriching experiences. Some community centers and nonprofits pair retirees with younger learners for mutual skill exchange—such as teaching cooking in return for help with smartphone use. These arrangements foster connection while keeping costs low. Additionally, platforms like Coursera, edX, and FutureLearn allow users to audit many courses for free. While certification may require payment, the knowledge itself is accessible at no cost. By combining these strategies, retirees can maintain an active, curious mind without straining their finances.

Balancing Risk and Reward: When to Invest (and When to Walk Away)

Not every learning opportunity is worth its price tag. In retirement, time and money are both precious, so evaluating educational investments with care is essential. Think like an investor: assess the potential return on investment (ROI) of each course or program. Ask: Will this skill improve my daily life? Could it lead to a meaningful hobby or modest income? Is the provider reputable? How much time will it require? A $300 course in genealogy may bring deep personal satisfaction if you’re passionate about family history, but the same amount spent on a trendy certification with no clear application may yield little value.

Credibility matters. Before enrolling, research the institution or instructor. Look for reviews, accreditation, or affiliations with recognized organizations. Be cautious of programs that promise dramatic outcomes—such as “become fluent in six weeks” or “start earning money immediately.” These claims often signal overstatement. Reputable providers focus on realistic outcomes and measurable progress. Also, consider the time commitment. A 12-week course requiring 10 hours per week may not be feasible if you have health limitations or caregiving responsibilities. The best learning fits your lifestyle, not the other way around.

Red flags include aggressive sales tactics, automatic subscription renewals, or lack of refund policies. Some online platforms lure users with a free trial, only to charge full price without clear notice. Always read the terms. A simple decision framework can help: list the benefits, costs, and alternatives. If the drawbacks outweigh the advantages, walk away. Remember, saying no to one opportunity creates space for a better one. Protecting your financial and emotional well-being is just as important as staying intellectually active.

Turning Skills Into Side Income: The Hidden Benefit of Late-Life Learning

Learning in retirement doesn’t have to be a one-way expense—it can become a source of modest income. Many retirees discover that newly acquired skills open doors to low-pressure, fulfilling ways to earn extra money. This isn’t about returning to full-time work, but about leveraging knowledge and experience in flexible, meaningful ways. For example, someone who completes a course in basic accounting might offer budget coaching to neighbors. A retiree who learns digital photo editing could provide slideshow services for family events. These small ventures often begin as hobbies and grow into valued community contributions.

Tutoring is one of the most accessible paths. With strong communication skills and subject knowledge, retirees can tutor students in math, reading, or foreign languages—either in person or online. Platforms like Wyzant or Care.com connect tutors with families seeking help. Even without formal teaching experience, life experience counts. A former engineer can explain physics concepts; a retired nurse can guide students through biology. Rates vary, but earning $20 to $40 per hour adds up, especially when sessions are limited to a few hours a week.

Consulting is another option. If you spent decades in business, healthcare, or education, your insights remain valuable. Short-term consulting gigs—such as helping a small nonprofit set up a database or advising a startup on operations—can be completed remotely and on your schedule. Websites like Upwork or Fiverr allow retirees to offer services without long-term commitments. Creative skills also translate into income. A retiree who learns pottery might sell pieces at local craft fairs. Someone who studies writing could contribute articles to community newsletters or blogs.

The financial benefit is clear, but the emotional reward is equally important. Earning even a small income reinforces a sense of purpose and competence. It reminds retirees that their knowledge matters. When learning leads to contribution, it transforms from consumption into creation—a powerful shift that supports both financial resilience and personal well-being.

Technology’s Role: Cutting Costs While Expanding Access

Technology has democratized education in ways unimaginable just two decades ago. For retirees, digital tools offer unprecedented access to high-quality learning—often at low or no cost. The key is using these resources wisely and avoiding common pitfalls. Free online courses from universities, virtual museum tours, language apps, and instructional videos on platforms like YouTube have made knowledge more accessible than ever. But without guidance, it’s easy to waste time or fall into subscription traps that erode savings.

Start with what’s already available. Most public libraries provide free access to premium learning platforms. All it takes is a library card and a few minutes to set up an account. Similarly, many tech companies offer discounted or free services to seniors. For example, some internet providers have low-cost plans for qualifying individuals. Public spaces like libraries, community centers, and cafes often offer free Wi-Fi, enabling access without a home connection. When using public networks, stick to secure websites (look for “https”) and avoid entering sensitive financial information.

Be strategic with apps and subscriptions. Many learning platforms offer free versions with limited features. Use these to test a service before paying. Cancel free trials immediately after use unless you’re certain you’ll continue. Set calendar reminders to review recurring charges monthly. A forgotten $15 app subscription can cost $180 a year—money better spent on a course with tangible outcomes. Also, explore open-source software. Instead of paying for expensive photo or video editing tools, try free alternatives like GIMP or DaVinci Resolve. These programs offer professional-level features at no cost.

Finally, don’t underestimate the power of peer support. Join online forums or local tech groups where retirees help each other navigate digital tools. Learning how to use a tablet or troubleshoot a software issue doesn’t have to be a solitary struggle. Shared knowledge reduces frustration and increases confidence. When technology serves as a bridge—not a barrier—retirees gain access to a world of learning that enriches both mind and budget.

Making It Last: Sustainable Habits for Lifelong Financial and Intellectual Health

True success in retirement learning isn’t measured by how many courses you complete, but by how consistently you engage over time. Sustainability comes from building habits that align with both your curiosity and your financial reality. Start by scheduling regular financial check-ins—quarterly or semi-annually—to review your learning expenses, assess progress, and adjust goals. Are you staying within budget? Are certain courses delivering value? Is there room to explore something new? These reflections keep your plan dynamic and responsive.

Accountability also plays a role. Share your learning goals with a trusted friend or partner. Better yet, find a learning buddy—someone also interested in personal growth. Studying together, discussing ideas, or simply checking in weekly creates motivation and reduces isolation. Many community centers and senior organizations host informal learning circles where members take turns teaching short lessons. These groups foster connection while keeping costs minimal.

Balance is essential. While staying active mentally is important, so is protecting your financial foundation. Avoid the temptation to overspend on the latest course trend or high-profile certification. Stick to your budget, prioritize value, and remember that depth often matters more than quantity. One deeply engaging course can be more rewarding than five superficial ones. Likewise, revisit topics over time. Relearning strengthens memory and deepens understanding, all without additional cost.

In the end, the goal is harmony—between curiosity and caution, growth and stability. Retirement offers a rare opportunity to learn for the joy of it, not for a grade or a promotion. When financial planning supports that freedom, the rewards multiply. You gain not only knowledge but confidence, purpose, and peace of mind. By making thoughtful choices today, you ensure that your retirement remains rich in every sense of the word—intellectually, emotionally, and financially.