What I Wish I Knew Earlier About Protecting My Health Wealth

You wouldn’t wait until you’re sick to think about healthcare—so why wait until a financial crisis hits to protect your future? I learned this the hard way, pouring money into risky bets that promised quick wins but left me stressed and broke. It wasn’t until I treated my finances like preventive care—focusing on balance, protection, and long-term strength—that everything changed. This is how smart asset allocation became my financial immune system. Just as regular check-ups catch health issues early, consistent financial habits can prevent small setbacks from becoming major disasters. The goal isn’t perfection, but resilience. And for someone managing a household, planning for children’s education, or preparing for retirement, that kind of stability isn’t just comforting—it’s essential.

The Wake-Up Call: When My Portfolio Got Sick

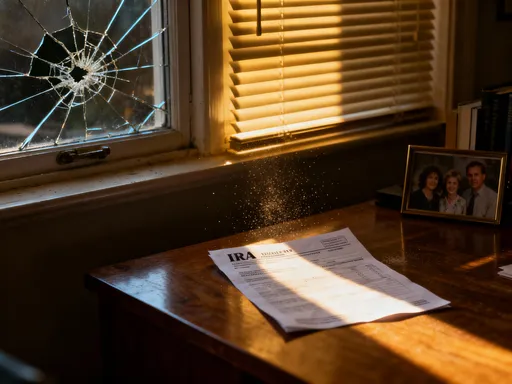

There was a time when I believed the only measure of financial success was how high my returns climbed. I watched stock tips, followed market trends, and moved large portions of my savings into what seemed like the next big thing. I felt smart, even powerful, watching numbers rise. But then the market shifted. A broad downturn hit, and within weeks, I lost nearly 30 percent of my portfolio’s value. What hurt most wasn’t just the dollar amount—it was the sense of helplessness. I had no plan for when things went wrong. I had ignored warning signs, dismissed the importance of safety, and assumed growth would continue forever.

That experience changed my perspective completely. I began to see my finances not as a game to win, but as a system to protect. Just as we don’t wait for illness to start eating well or exercising, we shouldn’t wait for a financial emergency to start building safeguards. The parallel between health and wealth became clear: both require consistent, thoughtful care to remain strong over time. Without preventive measures, even the strongest outward appearance can hide serious vulnerabilities. My portfolio wasn’t built to survive stress—it was built to impress, and that distinction cost me dearly.

Looking back, I realized my mistakes were common but avoidable. I had no emergency fund, so when the market dropped, I panicked and considered selling other assets to cover household expenses. I was overexposed to technology stocks, believing they would always outperform. I didn’t understand how correlated my holdings were, meaning they all fell together when sentiment shifted. Most importantly, I hadn’t defined my risk tolerance or long-term goals clearly. I was reacting, not planning. That period of stress taught me that financial health isn’t about avoiding all losses—it’s about ensuring those losses don’t derail your entire life.

Asset Allocation as Financial Preventive Care

Once I accepted that protection mattered as much as growth, I began studying asset allocation—the practice of dividing investments among different categories like stocks, bonds, cash, and real estate. At first, it sounded dull compared to chasing hot stocks. But I came to understand that this quiet strategy is the backbone of lasting financial health. Just as a balanced diet supports the body’s ability to resist illness, a balanced portfolio supports your ability to withstand economic shifts. The core idea is simple: not all assets move in the same direction at the same time. When stocks fall, bonds often hold steady or even rise. When inflation climbs, real estate and commodities may offer protection.

The "why" behind asset allocation is rooted in market behavior. History shows that no single asset class outperforms every year. Some years, U.S. stocks lead. Others, international markets or bonds deliver better returns. By spreading investments across multiple types of assets, you reduce the impact of any one area underperforming. This doesn’t eliminate risk, but it smooths out the ride. Over decades, this consistency often leads to better outcomes than trying to pick winners year after year. Studies have shown that for most investors, asset allocation explains the majority of portfolio performance over time—more than stock-picking or market timing.

So how do you apply this? The "how" starts with understanding your personal situation. Are you saving for retirement in 30 years, or do you need access to funds in five? Are you comfortable with fluctuations, or do big swings keep you up at night? These questions help determine your ideal mix. A common starting point is the "age in bonds" rule—for example, if you’re 50, you might keep about 50 percent in safer assets like bonds and cash. But this is just a guideline. Some people need more aggressive growth; others prioritize stability. The key is to create a target allocation and stick with it through market ups and downs.

The Hidden Trap: Overconfidence in High-Risk Plays

One of the most dangerous financial traps isn’t greed—it’s overconfidence. I fell into this myself. After a few lucky wins in individual stocks, I began to believe I had a special insight. I shifted more money into speculative sectors, telling myself I was being strategic. I read articles about "disruptive" companies and convinced myself I was ahead of the curve. But in reality, I was reacting to noise, not data. My decisions were driven by emotion—excitement, fear of missing out, and a desire to feel in control. When those bets failed, I had no backup plan.

Overconcentration in any single asset class is risky, even if it’s popular at the moment. Putting too much into tech stocks, real estate, or cryptocurrency may pay off temporarily, but it leaves you exposed when conditions change. Diversification isn’t about missing out on big gains—it’s about surviving the losses. A preventive approach means accepting that no one can predict the market perfectly. Instead of trying to beat it, you build a portfolio that can endure it. This mindset shift—from "How much can I make?" to "How much can I afford to lose?"—is what separates long-term success from short-term disappointment.

The danger of overconfidence is that it blinds us to our own limitations. We forget that markets are influenced by global events, policy changes, and human behavior—factors no individual can fully control. A well-allocated portfolio acts as a check on ego. It doesn’t rely on being right every time. Instead, it assumes mistakes will happen and builds in protection. This isn’t pessimism—it’s prudence. Just as a seatbelt doesn’t mean you expect a crash, diversification doesn’t mean you expect failure. It simply prepares you for the unexpected.

Building Your Financial Immune System: Core Components

If asset allocation is the foundation, then three key practices strengthen your financial immunity: liquidity, diversification, and rebalancing. Each plays a distinct role in keeping your wealth resilient. Liquidity refers to having cash or easily accessible funds available for emergencies. Think of this as your financial white blood cells—always on standby, ready to respond when trouble arises. Whether it’s a car repair, medical bill, or job loss, having three to six months of living expenses in a savings account prevents you from selling investments at a loss. This simple step alone can protect your long-term goals from short-term shocks.

Diversification goes beyond just mixing stocks and bonds. It means spreading investments across different industries, company sizes, countries, and asset types. For example, owning both large U.S. companies and emerging market funds reduces your dependence on any one economy. Including alternatives like real estate investment trusts (REITs) or commodities can add another layer of balance. The goal isn’t to own everything—it’s to avoid overexposure to any one risk. When one part of your portfolio struggles, others may hold steady or even gain, helping to offset losses.

Rebalancing is the third pillar—your financial check-up. Over time, some investments grow faster than others, shifting your original allocation. For instance, if stocks perform well, they may grow from 60 percent of your portfolio to 75 percent, increasing your risk. Rebalancing means selling some of the winners and buying more of the underperformers to return to your target mix. This enforces discipline, making you sell high and buy low without having to time the market. Many investors skip this step because it feels counterintuitive, but it’s essential for maintaining balance and managing risk over time.

Emotional Discipline: The Mindset Behind Sustainable Investing

One of the hardest lessons I learned is that the biggest threat to financial health isn’t the market—it’s our own emotions. Fear and greed drive impulsive decisions that undermine even the best plans. I’ve sold stocks after a drop, locking in losses, only to watch them recover months later. I’ve bought into trending assets at peak prices, hoping for quick gains. Each time, I acted against my long-term strategy because I felt pressure to "do something." But the truth is, often the best move is to do nothing.

Emotional discipline isn’t about ignoring feelings—it’s about designing a system that doesn’t depend on perfect behavior. That’s where automation helps. Setting up automatic contributions to retirement accounts or investment funds removes the need to decide when to invest. Similarly, scheduling regular rebalancing takes the emotion out of adjusting your portfolio. When changes happen on a calendar, not a headline, you’re less likely to react to temporary noise. This consistency builds wealth gradually, without drama.

Another powerful shift is changing how you view investing. Instead of seeing it as a way to get rich, think of it as a form of long-term self-care. Just as brushing your teeth daily prevents cavities, consistent investing prevents financial decay. You won’t see dramatic results overnight, but over years, the effects compound. This mindset reduces the urge to chase trends and increases patience. It also makes the process less stressful, because your focus isn’t on beating the market—it’s on staying the course.

Tailoring Your Plan: No One-Size-Fits-All Strategy

One of the most freeing realizations was that there is no single "right" way to invest. What works for a young tech worker may not suit a parent managing household budgets or someone nearing retirement. Your financial plan must reflect your life, not someone else’s. Age matters—a 30-year-old can usually afford more risk because they have time to recover from downturns. But a 55-year-old may need more stability to protect savings before retirement. Income, expenses, health, and family responsibilities all shape what a sustainable strategy looks like.

I spent months testing different allocation models before finding one that felt right. I started too aggressive, then overcorrected to too conservative. The balance I found includes a mix of U.S. and international stocks, high-quality bonds, and a small portion in real estate funds. My cash reserve covers six months of essential expenses. I review everything once a year, adjusting as my goals change. This plan isn’t the highest-return option available, but it’s one I can stick with through market swings. That consistency is more valuable than any short-term gain.

Customization also means being honest about your risk tolerance. Some people can watch their portfolio drop 20 percent and stay calm. Others feel anxious with a 5 percent loss. Neither is wrong—but knowing your limit helps you avoid making panic-driven decisions. A financial professional can help assess this through questionnaires and discussions. The goal isn’t to eliminate risk entirely, but to find a level that allows you to sleep at night while still working toward your goals. Regular check-ins ensure your plan evolves as your life does.

Long-Term Gains: Why Prevention Beats Crisis Management

Looking back, I realize that the real benefit of preventive finance isn’t just financial—it’s emotional. Since adopting a balanced, disciplined approach, my stress has decreased dramatically. I no longer check stock prices daily or lose sleep over market news. I know my plan is designed to weather storms, not just enjoy sunshine. This peace of mind is priceless, especially for those managing family finances, planning for education, or preparing for retirement.

Prevention also delivers better long-term results. While aggressive portfolios may surge in good years, they often suffer deeper losses in downturns. These big swings reduce compound growth over time. In contrast, balanced portfolios with moderate returns and lower volatility tend to outperform over decades. The math is clear: avoiding large losses preserves capital, allowing gains to build more steadily. I’ve seen my net worth grow more reliably since focusing on protection rather than performance.

The greatest lesson I’ve learned is that financial health isn’t about hitting a specific number in your account. It’s about creating a system that supports your life, reduces stress, and adapts to change. Just as preventive healthcare helps you live longer and feel better, preventive finance helps you build lasting security. You don’t need to be an expert to start. You just need to care enough to prepare. By treating your money with the same attention you give your body, you create a foundation of strength that lasts a lifetime. That’s not just smart investing—it’s financial self-respect.