Credit Card Traps Exposed: What No One Tells You About Hidden Costs

You swipe your card, thinking it’s just a purchase — but what if it’s quietly draining your wallet? I’ve been there, lured by rewards and credit limits, only to face surprise fees and creeping interest. Credit cards can be powerful tools, but without smart cost analysis, they become financial quicksand. Let’s break down the real price behind the plastic and how to use it without paying more than necessary.

The Illusion of "Free Money" – Understanding Credit Card Debt

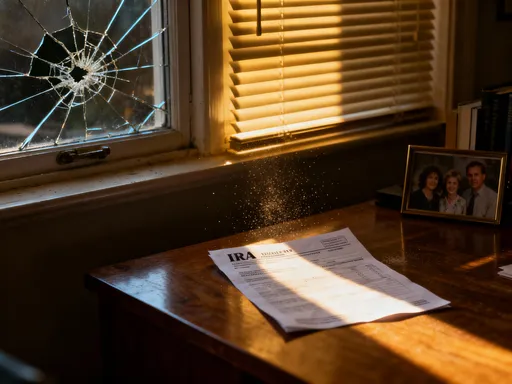

Credit cards create the illusion of financial freedom, offering immediate access to funds with no upfront cost. For many, this feels like free money — a convenient way to bridge gaps between paychecks or make large purchases without saving first. However, this perception is dangerously misleading. Unlike income, credit must eventually be repaid, often with interest that compounds over time. When users treat their credit limit as disposable income, they risk accumulating balances that spiral beyond control. The psychological separation between spending and paying makes it easy to lose track of how much has been spent, especially when the bill doesn’t arrive until weeks later.

Revolving credit allows cardholders to carry a balance from month to month, but this flexibility comes at a steep price. Interest begins accruing immediately on unpaid amounts, and if only the minimum payment is made, the debt can linger for years. For example, a $3,000 balance on a card with a 19.99% annual percentage rate (APR) and minimum payments of 2% of the balance would take over 20 years to pay off — and cost more than $2,800 in interest alone. This means the original purchase effectively doubles in cost. Many consumers do not realize that minimum payments are structured to extend repayment as long as possible, benefiting the issuer far more than the borrower.

The true danger lies in delayed repayment. Even small balances, when left unpaid, generate interest that increases the total amount owed. Over time, interest compounds daily, meaning new charges are added to the principal, and future interest is calculated on the higher amount. This compounding effect accelerates debt growth, particularly when new purchases are made while old balances remain. Without a clear understanding of how interest accumulates, cardholders may believe they are managing their finances responsibly while unknowingly falling deeper into debt. Recognizing that credit is not income but a short-term loan is the first step toward avoiding this trap.

Breaking Down the Real Costs – A Closer Look at Fees and Charges

Beyond interest rates, credit cards come with a complex web of fees that can significantly increase their cost. These charges are often buried in fine print or overlooked until they appear on a statement, catching users off guard. Annual fees, for instance, are common on premium cards offering travel perks or high cashback rates. While these benefits may seem appealing, the fee must be justified by actual usage. A card charging $95 per year only makes sense if the rewards and savings exceed that amount. Otherwise, it becomes a net loss rather than a financial advantage.

Foreign transaction fees are another hidden cost, typically ranging from 1% to 3% of each purchase made outside the user’s home country. For frequent travelers or online shoppers buying from international retailers, these fees add up quickly. A single $1,000 purchase could incur an extra $30 in charges — money that could have been saved by using a card with no foreign transaction fees. Cash advance fees are even more costly, usually amounting to 3% to 5% of the withdrawn amount plus a higher interest rate that begins accruing immediately, with no grace period. ATM withdrawals using a credit card should be avoided unless absolutely necessary, as they combine high fees with rapid interest accumulation.

Late payment penalties remain one of the most common and avoidable fees. Missing a due date by even one day can trigger a late fee of $25 to $40, and repeated missed payments may lead to penalty APRs — interest rates that can jump to 29.99% or higher. These increased rates apply not only to new purchases but also to existing balances, dramatically increasing the cost of debt. Additionally, some cards impose inactivity fees or balance transfer fees, further eroding value. To minimize these costs, consumers must carefully review their card agreements and choose products aligned with their spending habits. A no-fee card with a low interest rate may be more beneficial than a rewards card loaded with hidden charges.

Rewards That Cost More Than They’re Worth – The Dark Side of Perks

Rewards programs are among the most effective marketing tools used by credit card issuers. Points, miles, cashback, and sign-up bonuses create the impression of earning money with every purchase. However, these incentives are designed to encourage increased spending, often pushing users beyond their budgets. Studies have shown that consumers tend to spend 10% to 20% more when using credit cards compared to cash, and rewards amplify this tendency. The psychological appeal of “earning” something can override rational decision-making, leading to purchases made solely to accumulate points or meet bonus thresholds.

To determine whether a rewards program is truly beneficial, users must conduct a cost-benefit analysis. Consider a card offering 2% cashback on all purchases with a $95 annual fee. To break even, the cardholder must spend at least $4,750 per year. If spending exceeds this amount, the rewards may provide net value — but only if the balance is paid in full each month. If interest is incurred, even at a modest rate, it can easily erase any gains. For example, carrying a $1,000 balance for six months at 19.99% APR results in approximately $100 in interest — more than the annual fee and likely exceeding the cashback earned.

Travel rewards introduce additional complexities. While free flights or hotel stays sound attractive, they often come with blackout dates, limited availability, and high redemption rates. A card promising 50,000 bonus miles might require $4,000 in spending within three months — a target that could push users into debt if not carefully managed. Moreover, devalued reward programs can reduce the value of accumulated points overnight. Airlines and credit card companies frequently change terms, making previously valuable rewards less useful. Consumers should evaluate rewards not by their advertised potential but by their realistic, usable value based on actual spending patterns and lifestyle needs.

The Minimum Payment Trap – How Slow Repayment Inflates Costs

Minimum payments offer temporary relief but lead to long-term financial strain. Set at a small percentage of the outstanding balance — typically 1% to 3% — these payments make debt appear manageable in the short term. However, they are structured to prolong repayment, allowing interest to accumulate over many years. A $5,000 balance at 17.99% APR with minimum payments of 2% would take over 22 years to repay, resulting in nearly $4,000 in interest — almost 80% of the original balance. This means the cardholder pays significantly more than the value of the items purchased, turning a short-term convenience into a decade-long financial burden.

Amortization explains how each payment is split between interest and principal. In the early stages of repayment, the majority of the payment goes toward interest, with only a small fraction reducing the actual debt. For example, in the first month of a $5,000 balance at 17.99% APR, a $100 minimum payment would allocate about $75 to interest and only $25 to the principal. It takes years before the balance reduction accelerates, creating a frustrating cycle where progress seems minimal despite consistent payments. This slow erosion of debt discourages many from continuing, leading to eventual default or reliance on balance transfers to delay the inevitable.

The psychological comfort of making minimum payments masks the growing cost of debt. Users may believe they are staying current and avoiding penalties, but in reality, they are extending their financial obligation and increasing total expenses. The longer a balance persists, the more interest compounds, further inflating the final cost. To break free from this cycle, cardholders should aim to pay more than the minimum — ideally the full balance each month. When that’s not possible, setting a fixed monthly payment higher than the minimum can drastically reduce both repayment time and interest paid. Automating these payments ensures consistency and removes the temptation to delay.

Balance Transfers and Intro Offers – Useful Tools or Costly Illusions?

Balance transfer offers, often featuring 0% introductory APR for 12 to 18 months, are marketed as solutions for high-interest debt. On the surface, moving a balance from a card with a 20% rate to one with no interest for a year seems like a smart move. And in some cases, it is. When used responsibly, balance transfers can provide breathing room to pay down debt without accruing additional interest. However, these offers come with conditions that can turn them into financial pitfalls if not carefully managed.

Most balance transfer cards charge a fee — typically 3% to 5% of the transferred amount. Transferring $5,000 would incur a $150 to $250 fee upfront, which is added to the balance. While avoiding interest for a year may still result in net savings, the fee reduces the overall benefit. More importantly, the 0% rate is temporary. If the balance is not paid off before the promotional period ends, the remaining amount reverts to a standard interest rate, which could be 17% or higher. This can result in a sudden spike in interest charges, especially if the cardholder has grown complacent during the no-interest period.

Additionally, many introductory offers apply only to balance transfers, not new purchases. Any spending on the new card may accrue interest immediately, undermining the goal of debt reduction. There is also a behavioral risk: some users transfer a balance to free up credit on their old card, then continue using it, effectively doubling their debt. To use balance transfers effectively, consumers must have a clear repayment plan, commit to no new spending on the card, and ensure the full balance is paid before the promotional rate expires. Without discipline, what starts as a debt-relief strategy can become a deeper financial hole.

Credit Score Impact – How Card Use Affects Your Financial Health

Responsible credit card use plays a critical role in building and maintaining a strong credit score, which influences the cost of borrowing throughout life. A higher credit score leads to lower interest rates on mortgages, auto loans, and other forms of credit, saving thousands of dollars over time. Conversely, poor card management — such as missing payments, maxing out limits, or carrying high balances — can damage creditworthiness and increase future financing costs. The financial impact of credit card use extends far beyond monthly bills; it shapes long-term economic opportunities.

Several factors determine a credit score, with payment history and credit utilization being the most influential. Payment history accounts for about 35% of the FICO score, making timely payments essential. Even one late payment can cause a significant drop, especially for those with excellent credit. Credit utilization — the percentage of available credit being used — makes up another 30%. Experts recommend keeping utilization below 30%, and ideally under 10%, to maintain a healthy score. For example, a person with a $10,000 credit limit should aim to keep their balance below $3,000, and preferably below $1,000, at any given time.

Opening too many accounts in a short period or closing old ones can also negatively affect credit age and mix, which contribute to the overall score. While having multiple cards may offer convenience or rewards, each new application generates a hard inquiry, temporarily lowering the score. Closing an old account shortens the average age of credit history, which lenders view as a sign of stability. Therefore, even unused cards may be worth keeping open, provided they have no annual fee. By understanding how credit scoring works, users can manage their cards in ways that support both immediate financial goals and long-term credit health.

Smart Card Management – Building a Strategy That Saves, Not Costs

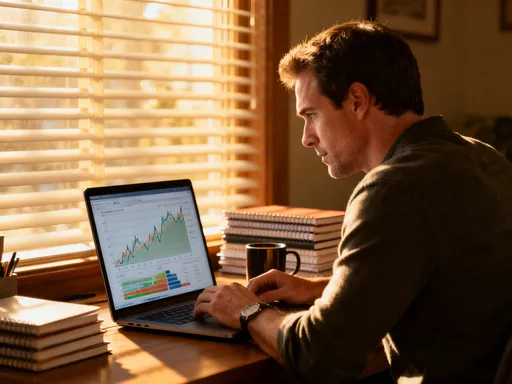

The key to using credit cards wisely lies in treating them as financial tools rather than spending enablers. A strategic approach begins with selecting the right card based on individual needs — whether it’s a low-interest card for occasional borrowing, a no-fee card for everyday use, or a rewards card that aligns with regular spending patterns. The best card is not the one with the most perks, but the one that minimizes costs while maximizing value. Reading the terms carefully, comparing fees, interest rates, and rewards structures helps avoid mismatched products that lead to unnecessary expenses.

Tracking spending is equally important. Many users lose sight of their balances because transactions are invisible compared to cash. Using budgeting apps or bank alerts can provide real-time visibility into spending habits, helping users stay within limits. Setting a monthly spending cap based on income and financial goals ensures that credit use remains sustainable. Equally crucial is paying the full balance each month. This practice avoids interest charges entirely and keeps credit utilization low, supporting both financial savings and credit score improvement.

Automation enhances consistency. Setting up automatic payments for the full balance — or at least the minimum, if a full payment isn’t possible — reduces the risk of missed due dates and late fees. Some banks allow customized payment amounts, enabling users to pay more than the minimum without manual effort each month. Aligning card usage with cash flow — such as making purchases shortly after payday — ensures there is enough money in the bank to cover the bill when it arrives. Over time, disciplined use transforms the credit card from a source of hidden costs into a reliable instrument for building financial security. Awareness, planning, and consistency are the foundations of smart credit card management — turning what many see as a trap into a tool for financial empowerment.